If this world was in any way rational, we would be going through a massive global property market crash right now.

Residential house prices have looked inflated for years – and by rights should have collapsed after the financial crisis in 2008. At the time, global central bankers saved property owners by unleashing massive fiscal stimulus and cutting interest rates almost to near zero, triggering yet another boom.

Central bankers are doing exactly the same today, averting a crash and in some parts of the world, driving prices to fresh highs.

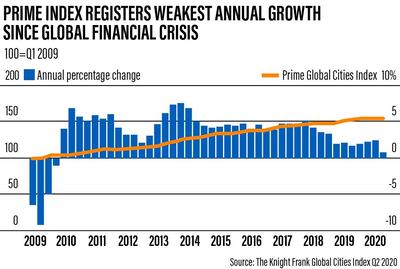

The Knight Frank Prime Global Cities Index for the second quarter of this year shows house prices fell by 2.3 per cent at the height of the Covid-19 pandemic, between March and June. Yet, they are still up over the year as a whole, if marginally, by 0.9 per cent.

Knight Frank researcher Kate Everett-Allen says the true picture is hard to gauge, as 29 of the 56 countries it tracks failed to report second quarter figures, amid the lockdown confusion.

She says the impact of the pandemic is likely to be “inconsistent and regular”, and vary from country to country. "Much will depend on the state of the housing market prior to the pandemic, the length and severity of the lockdown, and local reliance on international demand, which has dried up due to travel restrictions," she says.

Property markets seem to be holding up best in Eastern Europe, its figures show, with Luxembourg, Lithuania, Estonia, Poland, Slovakia and Ukraine posting double-digit price growth measured over 12 months.

Countries including South Africa, Singapore, Spain, India, Malta and Hong Kong are faring worst, but the declines are relatively minor so far. There is no global house price collapse. That doesn't mean it won't come, though.

In Dubai, prices fell for five years before the pandemic struck, although the stay-at-home restrictions have had only a minor effect.

Figures from listings portals Bayut and dubizzle show a decline of just 4 per cent in the first half of this year, despite the postponement of Expo 2020 Dubai to next year.

Global property market resilience may delight owners, but disappoint home buyers and investors who were hoping to bag a bargain during the crisis.

Chris Speller, group director of real estate exhibitions specialist Cityscape, has a simple message for those thinking of purchasing property in Dubai: “If you can afford it, now is a good time to buy. This is definitely a buyer’s market, with prices significantly lower than nine to 18 months ago.”

Some buyers may be tempted to wait in case prices fall further, but Mr Speller says the UAE is showing signs of recovery. "The government has been doing many things to attract business in the manufacturing, industrial, tourism and retail sectors. Many companies have already made job cuts, so we hope employment won’t fall further. This could support prices.”

Now is not a good time for speculators hoping to “flip” property for a quick profit, he says. “But for a private investor with a longer-term plan and job security, it could be a great opportunity.”

Before jumping in, Mr Speller advises checking the progress of local development plans. “If you were expecting a new mall or new roads and infrastructure, these may have been shelved for a period.”

Chris Battle, a buy-to-let investor who runs The Property Hub Meetup in Dubai, also suggests taking advantage of lower UAE prices. “The government could take action to protect prices by limiting new property supply until demand recovers."

Your decision depends on why you are buying, though. "If I was looking for a home to live in, I would definitely buy now. Even if prices fall, the money you are saving on rent will take the sting out of that.”

By contrast, property investors can afford to wait and see if a second global wave of the pandemic knocks confidence and prices, and throws up property bargains. “I don't think we have reached bottom in the UAE, but I don't think there is a lot further to fall,” Mr Battle says.

Travel restrictions have reduced demand from overseas buyers, but Professor Stephen Thomas, associate dean, MBA Programmes at the Business School in Dubai and London, says this could soon change as the weaker US dollar is making Dubai relatively cheap for buyers who earn in other currencies.

He predicts a surge in “lifestyle demand post-Covid as mature, well-off international buyers choose sun and security in the Gulf”.

Arran Summerhill, company director at Holo Mortgage Consultants in Dubai, says your decision also rests on how long you plan to hold the property. "If you aim to own for the medium to long term, you will always be in a position to ride out short-term market fluctuations.”

With UAE prices at their lowest in a decade, and mortgage rates at their lowest in history, buying today is tempting, he adds.

When deciding what to buy, Mr Summerhill says the lockdown has changed perceptions of what makes a desirable property. “Many buyers now favour villas or townhouses over apartments, to get additional outdoor space.”

One problem is that many Dubai owners have lost money on their properties and are reluctant to sell at today's depressed prices. They are hanging on, waiting for prices to recover.

Mr Summerhill says only those needing to sell urgently are doing so. “While plenty of buyers are looking to take advantage of today's favourable purchase conditions, supply is short."

Mr Thomas says falling Dubai prices have punctured the “dangerous myth” that property is always a good investment. “It depends when you buy and sell. As we have seen in the UAE, cycles occur with some regularity.”

Aaron Strutt, product and communications director at mortgage broker Trinity Financial, has been taking calls from British expats and other nationals in the UAE and Middle East, who are keen to take advantage of a current UK stamp duty holiday to buy in London.

The tax break runs until March 31, 2021, and saves buyers, including those living overseas, a maximum £15,000 (Dh71,374) on properties up to £500,000.

Foreign buyers have a second reason to act fast, as the stamp duty surcharge for overseas buyers rises from today's 3 per cent to 5 per cent from April 1, 2021.

This means an expat or overseas resident buying a £500,000 London bolthole would pay stamp duty of just £15,000 if they complete on March 31, but £40,000 the next day.

Wherever you buy, you should not let tax considerations dictate. The Centre for Economics and Business Research (CEBR) forecasts UK house prices will drop 14 per cent by the end of 2021. If it is right, overseas buyers would be better to wait. They may pay more stamp duty, but the overall cost will be much lower.

The truth is that property price movements, like shares, are impossible to predict. Especially since this is an artificial market, buoyed by government job protection programmes and years of low interest rates.

If you hold back waiting for the perfect moment to buy, the chances are you will never take the plunge.

Despite today's massive uncertainty, Mr Strutt says the demand is still out there. “People believe owning property gives them security, and renting is expensive.”

Low interest rates give you another good reason to take the plunge, he adds. “If you can lock into a fixed rate for five years at around 1.5 per cent, you should benefit for a long time to come."

One thing has not changed. If you have found your dream property and can afford the mortgage, the best time to buy is nearly always today.