The economic impact of the Covid-19 pandemic on global household spending has prompted consumers to reassess their spending habits and focus on saving for the future, according to a new study by market research company YouGov.

A majority of people cut back on non-essentials over the past six months to manage their daily living expenses during the pandemic, the report found.

YouGov's On the Money: Global Banking & Finance Report 2021 interviewed more than 19,000 consumers about their attitudes to financial services in 17 global markets, including Indonesia, Italy, Mexico, the UAE, Poland, Hong Kong, China, France, Australia, the US and UK, among others.

Movement restrictions during the height of the Covid-19 pandemic provided a number of plausible reasons for the reduction in spending in several markets, leading to consumers to actively limit their expenditure, the report said.

“Reduced expenditure may also relate to a general lack of options: people who are discouraged from or unable to travel, to eat lunch at a quick-service restaurant, to watch films at the cinema or to socialise … simply have fewer non-essential things to spend money on.”

However, pay cuts, furloughs and steep job losses around the world also contributed to the reduction in spending on non-essentials.

In Indonesia, 72 per cent of respondents said they lowered spending, followed by 56 per cent in Italy, 55 per cent in Mexico, 53 per cent in the UAE and 51 per cent in Singapore.

This compares with Denmark and Germany, which sit at the bottom of the list at 20 per cent and 28 per cent, respectively.

Meanwhile, the best-performing markets for savings include Hong Kong, where 37 per cent of consumers said they saved more money over the course of the pandemic, France with 36 per cent and Indonesia at 34 per cent.

After three hard lockdowns in the UK, only 24 per cent of Britons managed to save more, the report said. In the US, the hardest hit country with more than 500,000 deaths and a total of 28.8 million cases, according to Worldometer, which tracks the pandemic, just 22 per cent of respondents said they were able to save more.

In the UAE, 28 per cent of respondents saved more during the crisis, but 34 per cent dipped into their savings and 24 per cent borrowed more money to help manage their financial situation.

“On the surface of things, it looks like the Covid-19 pandemic has had a positive impact on people’s finances in many countries, but we know all too well how the average can often mask the reality,” Matt Palframan, director of financial services research at YouGov, said.

“Further work that we have done in Great Britain that measures levels of financial distress and over-indebtedness, reveals that a minority of consumers are struggling more now than they ever have,” Mr Palframan added. “This group were struggling before the pandemic and have been impacted the most by it."

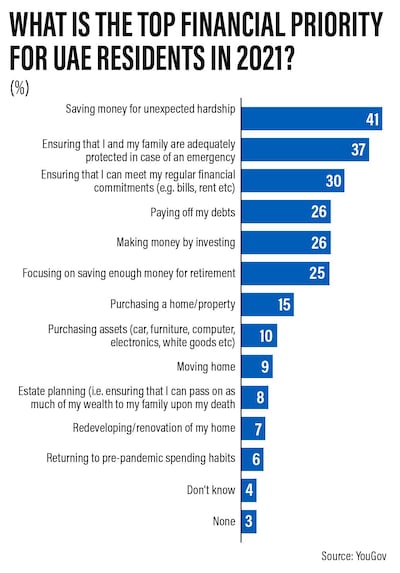

When questioned about their financial priorities for 2021, a significant number of consumers in each market said saving money for unexpected hardships is their top financial goal.

In the UAE, 41 per cent of consumers said an emergency fund is their priority this year, while 30 per cent said meeting regular financial commitments such as bills and rent is important and 26 per cent want to pay off their debts.

Respondents in Spain (55 per cent), the UK (49 per cent) and Sweden (47 per cent) are more likely to focus on fulfilling their regular financial commitments. Staying on top of bills is a lower priority in China (24 per cent), India (27 per cent) and Hong Kong (29 per cent).

However, as devastating as the pandemic has been for public health and the global economy, there has been a positive financial impact on a subset of global consumers, the report said.

“Those who currently work from home full-time may find themselves in a better financial position now that they no longer have the need to spend money on things such as travel,” it added.