Paul Allen

Billionaire Paul Allen plans to part with a trophy from his prized art collection.

A vibrant abstract painting by Willem de Kooning, Untitled XII, will be among the top highlights of Art Basel Hong Kong, an international fair that opens next week. Priced at $35 million, the canvas will be offered by Levy Gorvy Gallery.

Asian billionaires have been snapping up Western masterpieces at an accelerating pace. China is the second largest marketplace for art after the US, according to an annual art market report. Collectors from Korea and China have purchased at least 10 major de Kooning paintings in the past decade, according to Brett Gorvy, a co-founder of the gallery and former chairman of Christie’s postwar and contemporary art.

Billionaire collectors like Mr Allen, a co-founder of Microsoft, often prune their art holdings to finance new purchases.

“This sale is part of normal course of business for a collector like Paul,” says Alexa Rudin, a spokeswoman at Vulcan, Mr Allen’s family office that manages his business and charitable interests and whose staff includes 15 art experts. The work is being sold through the Paul G. Allen Family Collection, Ms Rudin says.

Mr Allen’s Gerhard Richter painting of a jet fetched $25.6m at auction in 2016, more than doubling since 2007. His painting by Mark Rothko sold for $56.2m at Phillips in 2014 and a monumental Barnett Newman canvas went for $43.8m at Sotheby’s in 2013.

The de Kooning - a vortex of flesh-toned brushstrokes and irregular shapes accentuated with bubble-gum pink and sky blue - was painted in 1975, the beginning of a two-year stretch considered among the most accomplished in the abstract expressionist artist’s life.

The six most expensive paintings by de Kooning at auction were created during this time, according to Artnet. His auction record: $66.3mfor a 1977 Untitled XXV sold at Christie's in 2016.

Mr Allen bought the de Kooning privately in 2001, but declined to say how much he paid.

James Packer

Billionaire James Packer quit the board of his casino operator Crown Resorts due to mental health issues, the latest turn in a turbulent private and business life that’s seen his overseas gaming empire unravel.

The 50-year-old Australian plans to step back from all commitments, says a spokesman, who didn’t elaborate on Mr Packer’s illness.

Twice-divorced Packer has endured a tumultuous few years, from the public breakup of his engagement with pop diva Mariah Carey, to the conviction of Crown employees in China in 2017 for illegal activities.

Today’s announcement comes about seven months after Packer returned to Crown’s board in the wake of the China crackdown. That ultimately led to Crown’s exit from Macau and the closure of most of its Asian offices to focus on its Australian business.

“Now that they’re more focused on their Australian assets, it’s a company that tends to run itself,” says Daniel Mueller, a fund manager at Vertium Asset Management in Sydney who downplayed the significance of Mr Packer’s departure from the board. “He’s got a lot of people around him, some of whom are on the board.”

Mr Packer has had an on-again, off-again involvement with the company - which his private investment company, Consolidated Press Holdings, owns about 47 per cent of - since stepping down as chairman and then as a director in 2015.

“Mr James Packer today resigned from the board of Crown Resorts for personal reasons,” a Consolidated Press spokesman said by email. “Mr. Packer is suffering from mental health issues. At this time he intends to step back from all commitments.”

Mr Packer was born into a media dynasty that owned Australia’s biggest magazine publisher. He took over the family business on his father Kerry’s death in 2005, and within three years sold most of its broadcasting and publishing stakes, as well as its cattle ranches, for more than $5 billion, using .the funds to build the stake in Crown.

In a rare interview with an Australian newspaper in October, Mr Packer said he wanted a more “simple life” and acknowledged he’d lost friends, put on weight and had led a reclusive life at his polo estate in Argentina.

“It has been a tumultuous four or five years for me,” Mr Packer said.

Evan Lucas, an independent market analyst and consultant based in Melbourne, said Packer endured more public scrutiny than most other Australian executives because he’s “a large figure in the business world.”

“He has been under a reasonable amount of pressure,” Lucas said. “It’s a sad story to hear.”

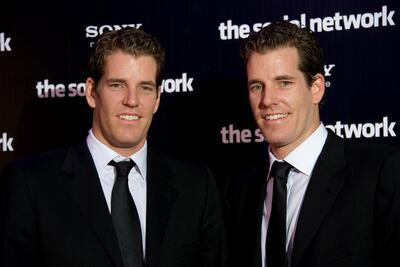

The Winklevoss twins

A UK fintech firm named after one of Eddie Murphy’s early movies has hooked up with crypto royalty.

Beeks Financial Cloud Group - whose name is a reference to the 1983 film Trading Places starring Murphy and Dan Aykroyd - signed a pact with Gemini Exchange, the crypto trading platform run by the billionaire Winklevoss twins. The agreement will allow Beeks' clients to trade Bitcoin and Ethereum through Gemini, according to a statement,

Glasgow, Scotland-based Beeks, which facilitates automated trading in forex and futures, sought a secure trading venue for cryptocurrencies following an increase in client demand, says chief executive Gordon McArthur,

“Gemini is one of the few cryptocurrency exchanges that are regulated and doing things properly,” Mr McArthur says. “This allows our institutional clients to connect to the exchange directly and get a proper equity exchange-like experience.”

Beeks debuted on the London Stock Exchange in November with a market capitalisation of about £23m($32.4 million).

Mr McArthur says the Gemini deal is a stepping stone in the company’s growth. “Lots and lots of our clients have been asking us to provide a low latency source of crypto liquidity and this partnership allows us to do it,” he says.

The company's reference to Clarence Beeks, an inside-trading antagonist in Trading Places, "is not something I like to admit," Mr McArthur says, adding that many of the company's other projects also have names referring to the movie.

One of Beeks Financial’s partner portals is called Winthorpe - a homage to the character Louis Winthorpe III who was played by Aykroyd.

Ivan Savvidi

Ivan Savvidi just had a week to remember. It started on March 11, when the pistol-packing Russian businessman charged onto a football field toward the end of a Greek Super League match to confront the referee for disallowing a last-minute goal. Five days later, he became a billionaire.

Mr Savvidi, 58, said he was “deeply sorry” for the incident, which prompted Greece to suspend the league and drew condemnation from FIFA, the sport’s governing body, as he and his team PAOK face hefty fines.

But then Japan Tobacco agreed to buy Savvidi’s company, Donskoy Tabak, for 90 billion rubles ($1.6bn), a hefty premium at a time when Russia is cracking down on smoking, including a planned tax increase for cigarettes and a proposed ban on sales to anyone born after 2015. The transaction, expected to be completed in the third quarter, would give Mr Savvidi a net worth of $1.7bn, according to the Bloomberg Billionaires Index.

While ethnically Greek, Mr Savvidi was born in Georgia under Soviet rule. He served in the army, rising to the rank of sergeant major, and began working at Don State Tobacco Factory in 1980. After studying at Rostov State University of Economics, Mr Savvidi took control of the government-owned enterprise in 1993, in the wake of the Soviet Union’s collapse.

Mr Savvidi distinguished himself by being the most aggressive and successful among the Russian producers in exploring international markets and introducing cigarettes with flavours such as Irish coffee.

Donskoy Tabak sells about 30 per cent of its cigarettes to foreign countries including Egypt and Transnistria, the self-proclaimed republic between Ukraine and Moldova, according to Maxim Korolev, who heads industry research firm Russkiy Tabak.

“Customers also like flavoured cigarettes, and they were the only big producer who made substantial efforts to address clients’ wishes” as the company developed a variety of products, he says.

Donskoy Tabak, founded in 1857, is Russia’s fourth-largest tobacco company with 7 per cent market share and had $278mof revenue last year, Japan Tobacco says.

Mr Savvidi transferred ownership of the company to his wife in 2003 when he was elected to the State Duma, Russia’s legislative body, according to Tatiana Gordina, his spokeswoman.

In addition to Donskoy Tabak, Mr Savvidi owns meat-processing and packaging businesses that are managed by his holding company Agrocom Group. His Atlantis-Pak is Russia’s biggest producer of plastic packaging for the meat products and cheese industries. He also controls RKZ-TAVR, a sausage maker, and Akva-Don, which bottles drinking water.

He has been accumulating assets in Greece, taking a controlling stake in the PAOK football club in 2012 and buying tobacco factory Sekap a year later. Last year he was part of the winning consortium that purchased state-run Thessaloniki Port Authority, and he also acquired significant Greek media interests.

Mr Savvidi endeared himself to football fans and was made an honorary citizen in 2013, a year after assuming the club’s debt. But he shocked spectators last week, when he charged onto the field in Thessaloniki to protest the referee’s decision while carrying a holstered gun and surrounded by bodyguards.

“I had absolutely no right to enter the pitch the way I did,” he said in his apology on the team’s website. “My only aim was to protect tens of thousands of PAOK fans from provocation, riots and casualties. Please believe I had no intention to engage in a brawl with our opponents or the referees. And I obviously did not threaten anybody.”