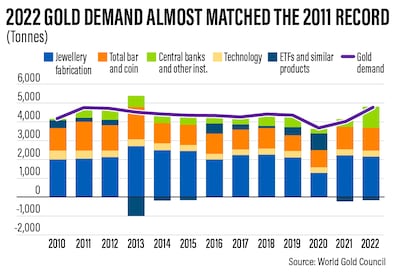

Gold demand rose by 18 per cent in 2022 to an 11-year high of 4,741 tonnes, driven by retail investors and central banks shoring up their bullion reserves, according to the World Gold Council.

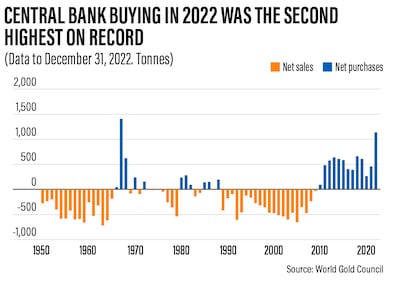

Annual central bank demand for gold more than doubled to 1,136 tonnes last year — its biggest yearly increase since 1967 — from 450 tonnes the year before, amid geopolitical uncertainty and high inflation, the WGC said in its annual report on Tuesday.

Among the central banks that bought gold last year were those in Turkey, China, Egypt and Qatar.

Investment demand for gold in 2022 was up 10 per cent from the previous year, the report said.

Retail investor demand was driven by a notable slowdown in exchange-traded fund (ETF) outflows and strong gold bar and coin demand, it added.

Brisk retail investment lifted bar and coin demand to a nine-year high. Strong growth in Europe, Turkey and the Middle East offset a sharp slowdown in China, where demand was dragged down by Covid-19-related factors, according to the WGC.

“Last year, we saw the highest level of annual gold demand in over a decade, driven in part by colossal central bank demand for the safe-haven asset,” said Louise Street, senior markets analyst at the WGC.

“Gold’s diverse demand drivers played a balancing act as rising interest rates prompted some tactical ETF outflows, while elevated inflation spurred on gold bar and coin investment.

“The need for wealth protection in the global inflationary environment remained a primary motive for gold investment purchases.”

A slowdown in US Federal Reserve interest rate increases is expected to boost the gold price.

Gold, which pays no interest, tends to benefit when interest rates are low as it reduces the opportunity cost of holding bullion.

Global economic growth is projected to rebound to 3.1 per cent in 2024, the International Monetary Fund said in its World Economic Outlook report released on Tuesday.

The IMF raised its global economic growth estimate for this year by 0.2 percentage points to 2.9 per cent from its October forecast, a slowdown from the 3.4 per cent expansion in 2022 and below the historical average of 3.8 per cent over the 2000-2019 period.

The fund said better economic data in the third quarter of last year, cooling inflation and the reopening of China point to resilience in the global economy.

Despite the revision, the Washington-based lender warned that the financial environment remained “fragile” as the fight against inflation is not over and will continue to weigh on the global economy, along with Russia’s war in Ukraine.

Meanwhile, global jewellery demand softened 3 per cent in 2022 to 2,086 tonnes, according to the WGC.

The weakness was driven by a drop in Chinese jewellery demand, which was down 15 per cent as consumer activity was curtailed by Covid-19 lockdowns for most of the year, the report said.

India, the world's second-biggest gold buyer, recorded a 2 per cent decline in gold jewellery demand in 2022, as a rally in local prices to near-record highs curtailed bullion demand during the key December quarter.

Jewellery demand in the Middle East was 15 per cent higher last year, with key contributions from the UAE and Saudi Arabia.

The gold price rally in the fourth quarter also contributed to the annual decline in jewellery demand, the WGC said.

The gold price hit a record annual average of $1,800 per ounce last year, despite facing headwinds from the strong US dollar and rising global interest rates.

Demand for gold in technology dropped by 7 per cent annually as deteriorating global economic conditions hampered demand for consumer electronics, the report said.

Total gold supply in 2022 was up by 2 per cent annually to 4,755 tonnes and remained above pre-pandemic levels. Mine production increased to 3,612 tonnes, hitting a four-year high.

“Turning to 2023, economic forecasts are pointing to a challenging environment and a likely global recession, which could lead to a role reversal in gold investment trends,” Ms Street said.

“If inflation comes down, this could be a headwind for gold bar and coin investment. Conversely, continued weakening of the US dollar and the moderating pace of interest rate hikes could have positive implications for gold-backed ETF demand.”

Jewellery consumption will remain resilient, bolstered by a release of pent-up demand as China reopens, she said.

However, it could be dragged down by a consumer spending squeeze if there is a more severe downturn.