British Airways must seek to merge with or buy up rival carriers if it is to match the growing global dominance of airlines in the Arabian Gulf, the company's chairman said yesterday.

Sir Martin Broughton also admitted that the decision to admit Qatar Airways into the Oneworld Alliance this week marked the culmination of a strategic shift for BA that amounted to "If you can't beat them, join them".

BA has in the past criticised Gulf carriers, claiming that they enjoy government support that gives them a competitive advantage over international rivals.

"We decided, I suppose, to look through the other end of the telescope in a sense," Sir Martin told The National.

"The consumers are not interested in whether [Gulf carriers] are a strategic threat, whether they are subsidised or not subsidised. They like Gulf carriers, and if we want to have an alliance that meets our consumers' demands, we thought we ought to have one here."

Qatar Airways made the announcement that it was joining the Oneworld alliance a day after Etihad Airways signed a 10-year "major strategic agreement" with Air France-KLM, and only weeks after Emirates Airline and Qantas signed a deal that will result in the Australian carrier routing its flights to and from Europe through Dubai rather than Singapore.

Gulf carriers have already begun to take market share from more established players by leveraging their geographical position and more modern fleets to fly passengers between Europe, Asia and Africa more cheaply.

Sir Martin, who was speaking as BA marked its 80th anniversary of flights to the region, said that for his airline a "key part" in contending with Gulf carriers' growing stature in the industry would be deregulation and the permitting of acquisitions, as well as allowing airlines to "go bust".

"[Acquisitions are] a key part," he said, declining to name any potential targets for BA.

"Airlines suffer from financial problems. It seems to be an inherent part of the industry; part of it is down to the inability to do mergers and acquisitions. Airlines which should be allowed to go bust … get propped up, very often by governments, [which] very often means they are subsidised."

BA tied up with the Spanish airline Iberia in 2010 and the two carriers now sit under the umbrella of the International Airlines Group (IAG).

IAG is in the process of restructuring Iberia after a €390 million (Dh1.84 billion) loss for the group in the six months to the end of June.

Outside Europe, the ability of airlines to merge or acquire other carriers is limited because of the political sensitivity connected to taking over a national carrier.

In the United States, foreign ownership of airlines is limited to 25 per cent, and in the European Union the limit is to 49 per cent.

In other parts of the world, job losses and damage to competition are often cited as concerns over acquisitions.

"One of the key things is government regulation around the world which limits shareholdings of foreign nationals," said John Strickland of JLS Consulting, based in London. "Airlines are not as free around the world to buy into each other as they might wish. That's why we see these alliances and code-shares."

Even in the Indian market, where carriers are struggling under the weight of US$20bn (Dh73.45bn) of debt, the government only last month announced it would allow foreign airlines to invest in private carriers to a maximum of 49 per cent.

Sir Martin said carriers such as Air India and Alitalia had "no right to exist" in a competitive and free market. He added that he "did not know" if Gulf carriers were subsidised.

"India is a classic example. Air India has no right to exist, it should have gone bust a while ago. It's been propped up time and time again by government subsidies," he said.

"Those government subsidies [have] cut the prices to uneconomic fares which have driven Kingfisher and Jet [Airways] et al into financial difficulties. The players that could have made it … have been driven either to bankruptcy or to the verge of it by an inefficient subsidy."

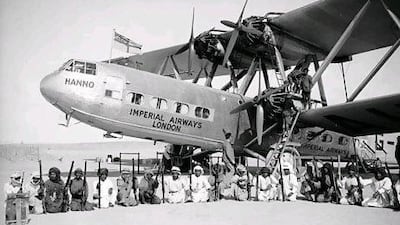

BA's first flight to the region touched down in Sharjah on October 7, 1932, under the banner of its predecessor Imperial Airways.