Businessman Arif Naqvi sought to defend his reputation just days before his arrest in London claiming that nobody had a "bad word to say about him" despite the collapse of his multi-billion-dollar private equity fund.

In rare comments after leaving the UAE in the wake of the scandal, Mr Naqvi sought to deflect questions about the failure of the Abraaj Group he founded.

In an exclusive interview with The National, he said he was working with liquidators to "solve their issues" as they tried to assess if anything that had happened was "not normal".

Since the company's collapse, Mr Naqvi, 58, had been keeping a low profile in Britain where his family have at least two properties held in the names of companies registered in British Virgin Islands.

When contacted by The National before his arrest, Mr Naqvi declined to say where he was staying, but British police confirmed he was arrested on Wednesday at Heathrow Airport on behalf of the US authorities. Mr Naqvi, who was thought to be trying to leave the country, has been detained and will appear in court via a video link for an extradition hearing next Thursday.

Mr Naqvi, the dominant figure at Abraaj, had earlier told The National that he was not avoiding a return to the UAE and said he was prepared to go back to answer questions if requested.

But his arrest in London for allegedly misappropriating more than $230 million in fund money raises the prospect of lengthy extradition hearings that could limit his movements.

Abraaj was the largest buyout fund in the Middle East and North Africa until it collapsed last year after the fallout with investors, including the Gates Foundation, which questioned the use of their money in a $1 billion healthcare fund.

In his comments to The National, Mr Naqvi said questions about the state of the company – which at its peak managed more than $14bn in assets - were for provisional liquidators to answer.

“Generally speaking, people don’t have a bad word to say about me who know me,” he said by phone last month. “Generally speaking, people who know me and who are involved with the Abraaj estate are being very sensible.

“That’s why we appointed provisional liquidators for them to examine the estate and figure out if anything needs to be done, did anything happen that was not normal and, if so, what steps they should take.

“I don’t have any personal creditors and I’m working with JPLs [joint provisional liquidators] to solve their issues.”

Mr Naqvi, who studied at the London School of Economics, has close links with the UK. London hosted one of the 20 Abraaj offices dotted around the world, while his wife Fayeeza, who is listed in public records as living in a mansion block in London’s upmarket Knightsbridge district, had roles with two UK-registered charities.

They include the Aman Foundation UK, the British arm of a charity set up by the Naqvis in Pakistan in 2008 to deliver health and education programmes there.

Aman Foundation UK had offices at the Abraaj Group London’s headquarters in Mayfair – home to the most expensive commercial property in London – which was closed last year as part of a “normal cost-cutting measure in an insolvency”, according to reported comments by the provisional liquidator.

Aman Foundation UK, which spent more than £2m in 2016-17, also moved out of its office at Grosvenor Gardens, close to Buckingham Palace in central London in December 2017, according to records held by the office supplier.

Calls to the charity for a comment were not returned

Mr Naqvi’s arrest raises fresh questions for creditors and concerns about the financial health of charities connected to the Naqvi family.

But the businessman said last month that his business woes had not impacted the Aman Foundation in Pakistan, which provides a fleet of ambulances.

The couple won a prize from French banking group BNP Paribas for their “individual philanthropy” in 2015.

In a video with his wife that accompanied the award, Mr Naqvi said: “The more you measure, the more clarity you provide, the more governance you show to the world at large what your foundation is experiencing, more people will come in and support that effort.” He had championed the role of the private sector in providing health care in poorer countries. At the World Economic Forum, the gathering of the world’s business elite at Davos, Switzerland. The Abraaj founder told delegates that health care had been left for too long to governments and charity organisations.

He told The National the foundation had been getting sufficient donations from the community to continue its work “without a single hiccup”.

Mr Naqvi refused, however, to comment about rumours that he was selling his sprawling UK property in the countryside about 96 kilometres west of London.

Wootton Place has been one of the homes of Mr Naqvi and his family since 2006, when it was purchased by a British Virgin Islands-registered company for £9.5m. Locals in the sleepy hill-top village said they had no problem with their wealthy neighbours who had contributed an "immensely generous donation" to repair the village hall roof.

He once threw open the gates of the property to welcome villagers when members of Pakistan’s cricket team played a match on the private field. But with creditors on his heels, the Pakistani businessman has not been seen in Wootton for months amid village rumours that the property is up for sale.

The cricket pitch and golf green remain tightly mown and tidy but staff firmly rebuffed inquiries via the intercom at one of the two entrance gates to the substantial grounds.

“My spies tell me he hasn’t been here for a good while,” said Peter Loftus, the chairman of the local council at Wootton.

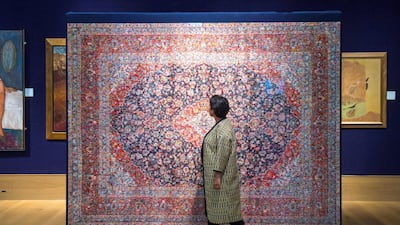

Liquidators have already sold the best of Mr Naqvi’s substantial art collection amassed during the boom years of the early 2000s.

A sale of 250 pieces in October last year at Bonhams auction house raised more than £4.5m. Mr Naqvi also last year settled two claims from a Sharjah businessman for issuing cheques with insufficient funds, a criminal offence in the UAE.

A statement issued by a spokesman for Mr Naqvi on Friday in relation to the US charges said: "Mr Naqvi maintains his innocence, and he fully expects to be cleared of any charges. For almost a year since the commencement of the provisional liquidations, he has been working tirelessly to maximise returns for Abraaj's creditors," the statement said.