LVMH is closing in on Tesla Inc. for ninth spot on the list of the world’s biggest companies by market capitalisation, only days after entering the top 10.

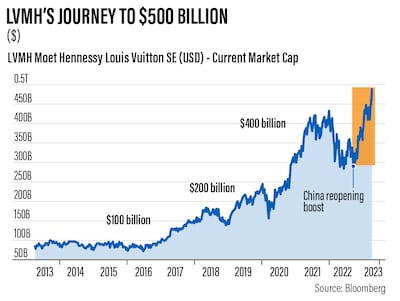

Shares in the luxury goods company have risen 6.9 per cent this month, lifting its market value to about $500 billion, helped by stronger-than-expected sales during the first quarter.

Shares of Tesla have fallen 23 per cent in the same time, cutting its market capitalisation to $505 billion as price cuts take a toll on the electric car maker’s profitability.

The men in charge of the two companies have already switched places on the Bloomberg Billionaires Index this year.

The rising market value of LVMH has swelled the wealth of Bernard Arnault to almost $212 billion, making him the richest person on earth, while Elon Musk is a distant second with wealth of $165 billion.

LVMH is the first European company to reach a market value of more than $500 billion, thanks to booming sales of luxury goods in China and a strengthening euro.

The achievement comes less than two weeks after LVMH joined the ranks of the world’s 10 biggest companies. Rival Hermes International subsequently published its own strong numbers, reinforcing the view that China’s reopening from pandemic lockdowns is fuelling growth across the industry.

LVMH and its French luxury rivals are to the European stock market what Big Tech has been to the US, dominant businesses whose growth holds up as the economy waxes and wanes. That is evident in the global market value rankings, with a host of technology companies dominating the list.

“Luxury stocks embody what the equity market has best to offer at the moment — exposure to Chinese consumption, which continues to surprise on the rise, and robust margins thanks to their pricing power,” said Lilia Peytavin, European portfolio strategist at Goldman Sachs in Paris.

“This differentiates luxury from tech, whose margins have been contracting for several quarters already.”

Demand has held up for LVMH products — Louis Vuitton handbags and Christian Dior gowns among them — despite surging inflation and rising interest rates threatening to tip the world into recession.

LVMH did caution this month that it is seeing a slowdown in US growth, with demand for leather goods particularly affected, and some investors fret that the stock inevitably will be hurt should the economic slowdown worsen.

For now, paradoxically, concern about a recession is lifting LVMH’s value in dollar terms. The euro this month jumped to its highest level in more than a year as the dollar slumped, fuelled by increasing market expectations that a worsening US economy will prompt the US Federal Reserve to cut interest rates this year.

Analysts have been raising their targets on LVMH’s stock. They see room for further gains, as 30 out of the 36 analysts tracked by Bloomberg have a buy-equivalent rating.

Bank of America's Ashley Wallace sees the stock hitting €1,000 in the next year. “LVMH is too cheap given the attractiveness of the luxury goods sector, its strong portfolio of brands and best-in-class execution,” Ms Wallace wrote in a report on April 13.

Mr Arnault, LVMH’s chairman and chief executive, made his foray into luxury in 1984, taking over Boussac Saint-Freres, the bankrupt textile group that owned Christian Dior. He spun off most of the company’s other businesses and used the windfall to buy a controlling stake in LVMH, whose two main companies, Louis Vuitton and Moet Hennessy, had merged in 1987.

Over the next three decades, and through dozens of acquisitions, he built LVMH into a luxury behemoth selling everything from spirits to leather goods to jewellery through more than 5,600 stores worldwide. He was quick to grasp that China would become a key market, opening the first Louis Vuitton store in Beijing in 1992.

Mr Arnault, 74, and his family own 48 per cent of LVMH’s share capital, and he has been laying the groundwork to keep the company under family control for decades to come.

The sprawling conglomerate, with its 75 labels ranging from Givenchy to Tiffany, became a training ground for ambitious designers seeking to make a name for themselves.

In February, Louis Vuitton named musician and apparel entrepreneur Pharrell Williams as the label’s menswear designer, filling the role previously held by Virgil Abloh, who died in 2021.

There is no sign Mr Arnault intends to step down any time soon.

LVMH last year lifted the age limit of its chief executive, which would allow him to stay at the helm until he is 80. The company has started to lay the groundwork for his succession, though, through a new holding company.