The aggregate net income of listed companies in the GCC surged almost 63 per cent in the second quarter to a record driven by a sharp rise in the profits of energy and financial institutions amid high oil prices and continued economic recovery in the region.

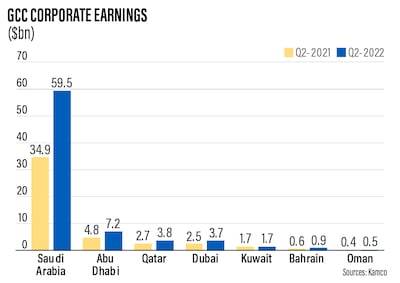

The cumulative net profit of publicly traded companies rose to $77.3 billion in the three months to the end of June, up from the almost $48bn recorded in the same period a year earlier, Kuwait-based Kamco Invest said in its latest report.

Banks, energy and materials were the top three sectors by “absolute profit growth” year on year during the period, accounting for almost 90 per cent of the total rise in aggregate net income.

“The region showed strong consumer and business sentiments during the quarter, despite a slowdown at the global level due to higher inflation and the efforts by central banks to tame rising prices,” Junaid Ansari, head of investment strategy and research at Kamco, said in the report.

Economies in the six-member economic bloc rebounded strongly from the Covid-19 pandemic-driven slump in 2021 and have carried the growth momentum into this year.

Saudi Arabia’s economy, the biggest in the Arab world, grew 9.9 per cent in the first quarter of this year, recording its highest rate of growth in the past 10 years. It grew a further 11.8 per cent in the second quarter, driven by high oil prices, flash estimates released earlier this month by the kingdom’s General Authority for Statistics (Gastat) showed.

The International Monetary Fund, in its latest forecast, estimated that the kingdom’s economy will grow 7.6 per cent in 2022 and 3.7 per cent in 2023, after expanding 3.2 per cent last year.

The UAE's economic output is poised to post its strongest annual expansion since 2011 after it grew by 8.2 per cent in the first three months of this year. A sharp increase in oil production, as well as a noticeable improvement in the real gross domestic product drove growth, the Central Bank of the UAE said in its latest Quarterly Economic Review 2022.

The UAE economy, which expanded by 3.8 per cent in 2021, is expected to grow by 5.4 per cent and 4.2 per cent in 2022 and 2023 respectively, the regulator said in July.

Higher oil prices, driven by the continuing Russia-Ukraine conflict, and regional governments’ efforts to stem inflation have also supported economic momentum.

Inflation in the GCC has been significantly lower than in most advanced and emerging market countries, Kamco said in a report earlier this month.

The IMF expects inflation to average 8.3 per cent globally this year, standing at 6.6 per cent in advanced economies and 9.5 per cent across emerging market and developing economies. The inflation rate in the GCC is expected to rise to 3.3 per cent in 2022 and 2.3 per cent for 2023, Kamco said, citing IMF data.

On a quarterly basis, the aggregate income of GCC-listed companies jumped almost 18 per cent from the $65.7bn reported at the end of the first three months of this year.

head of investment strategy and research, Kamco Invest

Saudi Aramco continued to be the biggest contributor to profit growth during the quarter. Excluding Aramco, the growth in aggregate profits came in at almost 33 per cent on an annual basis and about 11 per cent on a quarterly basis, Kamco said.

Growth in profitability was reported by all seven main exchanges in the region during the three-month period.

Saudi Arabia-listed companies reported the biggest surge in profit during the second quarter on an annual basis. Cumulative net income in the kingdom surged more than 70 per cent to $59.5bn.

Abu Dhabi and Bahrain followed, with year-on-year growth of 50 per cent and 62.4 per cent, respectively.