The new head of Libya's central bank has moved to reassure the world that the country's assets are safe and have not been plundered by the deposed regime.

With the ousted Libyan leader Muammar Qaddafi still on the run, the fledgling government is assessing the status of the country's assets -from oil installations to fiscal reserves.

"No assets of the Libyan Central Bank have been stolen, gold or otherwise," Gassem Azzoz, the bank's governor, told reporters in Tripoli on Thursday.

The bank holds US$115 billion (Dh422.3bn) - $90bn of that abroad - and a delivery of cash from the UK last month has ensured that there are no liquidity issues, Mr Azzoz said.

The National Transitional Council, which is Libya's interim government, has persuaded nations to unfreeze some assets so it can keep going, but it has yet to cast off the UN sanctions put in place to put pressure on the Qaddafi regime.

In April and May, the then Libyan government sold 29 million tonnes of gold, equivalent to $1.4bn at international spot gold prices then.

But the bank sold the bullion to merchants inside Libya, which means the precious metal could have fetched a lower price.

With reserves of 143.8 tonnes, Libya ranked among the world's 25 largest official sector gold holders, according to a World Gold Council report in July.

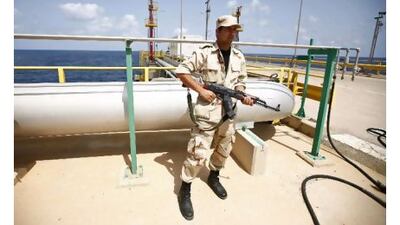

A post-Qaddafi Libya will need to rely on its core industry - oil - rather than its massive gold reserves, say analysts.

"They have to get oil up and running," said Liz Martins, the senior Middle East and North Africa economist at HSBC. "I don't think that any government will see selling gold in the central bank as a good financing strategy. They'll want to be getting the other kind of gold - the black gold - going."

Libya pumped 1.6 million barrels of oil per day (bpd) before the uprising in February, providing an estimated 80 to 92 per cent of government revenues.

But production fell to under 100,000 bpd as rebels and loyalists alike sought to cut off their opponents' source of fuel and income, according to a report from Bank of America Merrill Lynch.

Estimates of how soon Libya can regain its pre-conflict pumping levels range from the six months proposed by some members of the new government to the bleak three-year timetable predicted by the oil consultancy Wood Mackenzie.

Ali Tarhouni, the interim oil minister, said only 10 to 20 per cent of oil installations were damaged and that some production could resume within two weeks.

The damage, he told The Wall Street Journal this week, stemmed mostly from vandalism and looting.

The speed of the industry's revival depends on the willingness of foreign oil companies that had pumped oil under production-sharing agreements with the Qaddafi regime to send back their staff.

The new government has reassured the companies that those agreements will be honoured. But it has also said that contracts under way at the start of the conflict would need to be reviewed.

As much as $150bn in contracts hang in the balance, said Gene Cretz, the US ambassador to Libya.

"Some of them may be good, some of them may be continued, some of them may be ridiculous," he told reporters in Washington this week.

"There's been a lot of incompetence, certainly, and there's been a lot of corruption."

* With agencies