When the world entered Covid-19 lockdowns a year ago, few would have guessed that a retail investor revolution was about to take place.

As global stock markets crashed in March 2020, governments injected trillions of dollars in fiscal and monetary stimulus to prop up economies, which led to a market recovery when retail investors presented with government cheques piled into buying stocks.

But instead of doing this through traditional brokerages, novice day traders poured into commission-free online trading apps such as Robinhood, eToro, Interactive Brokers and the UAE's robo-advisory Sarwa, according to research released last month by the US-based Finra Investor Education Foundation and the National Opinion Research Centre at the University of Chicago.

"Market dips that made stocks cheaper to buy and the ability to invest with small amounts were among the top reasons younger and inexperienced investors reported entering the stock market," the study, Investing 2020: New Accounts and the People Who Opened Them, said.

Baraka, the UAE’s newest entrant into the commission-free online trading app sector, plans to dive into the retail investor revolution in the second quarter of this year, subject to regulatory approval, after recently raising $1 million in pre-seed funding,

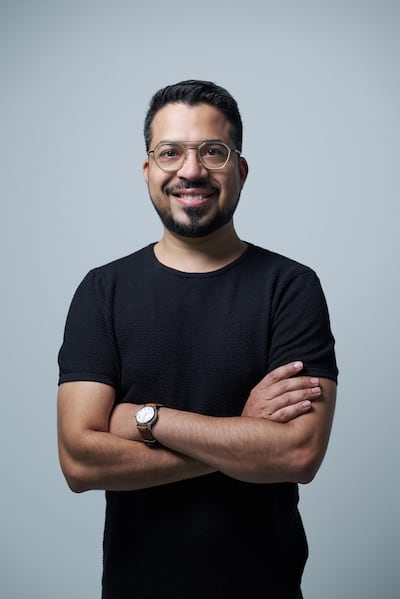

The FinTech start-up was co-founded in July last year by Dubai-based Feras Jalbout, the company’s chief executive, and Bahrain-based Kunal Taneja, baraka’s chief technology officer, who met online through mutual friends at the height of the Covid-19 movement restrictions.

“We have had an interesting journey founding this business during Covid,” says Mr Jalbout, who has a background in investment banking. “We've hired everyone over Zoom, we've raised money over Zoom, we got to know each other over Zoom and we just embraced it.”

Mr Taneja, who has been in the Middle East for 20 years, agrees. “It was not like a professional introduction of any sort,” he says. “So there was no recruiting wall, there was no headhunting. It was just through mutual connections and collaborating on something that what we thought could be the future.”

The Mena region has one of the highest smartphone penetration rates in the world, while 65 per cent of its population is under 35, according to a report by accountancy firm Grant Thornton.

And it is this digitally savvy demographic that baraka is targeting as it taps into the region's growing retail investor revolution, Mr Jalbout says.

“Young investors in the Middle East are becoming more conscious about the companies and causes they want to support. Whether it’s backing organisations that prioritise diversity and inclusion, seeking sustainable investment options or just helping their favourite brands to grow, millennials want a say in where their money is going.

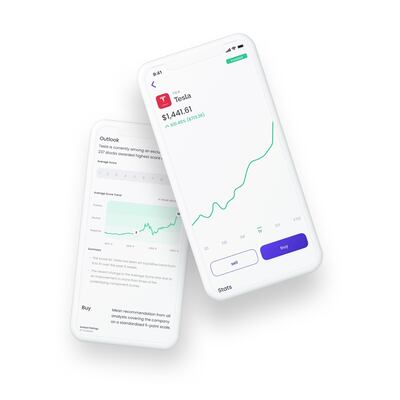

“So, we created a platform that would allow them to do that while addressing their two biggest challenges: limited access to US-listed stocks and a lack of understanding around how they work.”

When it launches across the GCC region, baraka will give investors access to more than 4,000 US listed securities, including stocks, exchange-traded funds and fractional shares. The platform will be available in both English and Arabic and will feature the local currencies of subscribers, Mr Taneja says.

“From very early on, we knew the market … and that basically meant that we had to localise the product,” he says. “Having the platform available in Arabic was the first thing that we wanted to have. In addition to that, there were other elements like having the entire portfolio in your local currency.”

A strong community focus and democratising online investing for millennials and Generation Z is an important tenet behind the inspiration for launching baraka, Mr Jalbout says.

“This is not a fleeting trend – I think it comes with the fact that we are now in a world where we are democratising access to all sorts of different asset classes … and the average Joe has access to different investment products,” he says.

“Everyone should be an investor. Traditionally, it’s been reserved for the ultra-wealthy or the extremely sophisticated [investors] or the ones that are very well connected. But now, we have a growing population of not just young people, but generally people who have an appetite for investing.”

Initially bootstrapped with an investment of $150,000, the co-founders plan to incorporate other features into the platform, including a daily market newsletter, in-app messenger and gamified investment quizzes.

Earlier this month, the company raised $1m in pre-seed capital from San Francisco-based venture fund Class 5 Global, New York investment firm FJ Labs, IMO Ventures, The Community Fund, VentureSouq and a private investment from Dr Abdulla Elyas, co-founder of the now Uber-owned Careem.

While it will offer zero-commission trading, Mr Jalbout and Mr Taneja plan to incorporate a paid tier into the platform that will offer subscribers added value, such as trading data and insights through its tie-up with research firm Refinitiv.

“Obviously, as we go along this journey, we have multiple ways to monetise where we create new products around retail investing,” Mr Jalbout says.

“Today, it's about creating this phenomenal product and experience for users. And I think if you do that, then monetisation will follow.”

Baraka recently opened a waiting list for traders to sign up to the platform, but over the past nine months has used a "phased approach" model to build its subscriber base organically with its newsletter akhbaraka, a combination of the company's name and the Arabic word for news, which is emailed to thousands of subscribers daily and has evolved into a podcast.

“When we started making the product, we also thought that it would be a good idea to have a pre-launch environment [because] we're very passionate about educating and making people aware of investments,” Mr Jalbout says.

“We had a good amount of subscribers in the couple of thousands … and they became the first adapters to the waitlist. [When the] whole referral campaign started, in just roughly about three days … we had almost tripled that number of subscribers.”

The partners plan to stand out from rival online trading apps by educating, enabling and empowering millennials to increase their investor knowledge and build their wealth, Mr Jalbout says.

One of baraka’s key differentiators is its content strategy and how it is building a community, he says.

“It’s fundamentally different from other products in the market, where the whole idea is to just say, give me your money and let me do it.

“What we want is to create is this overarching community for people to not only reach out to us, but reach out to other investors and have discussions, build their own kind of investor community and really learn from it.”

Q&A with Feras Jalbout and Kunal Taneja, co-founders of baraka

What other successful start-up do you wish you had started?

There are some really amazing success stories out there but if we had to choose one, it would be Amazon. The level that they have successfully scaled at and the way they’ve grown their product range to address their audience’s every need has been pretty incredible.

What new skills have you learnt since launching your business?

People management in a start-up environment has been a learning curve for both of us, especially with the challenge of hiring and managing a team almost entirely over Zoom. We’ve taken it in stride though and being an "online" team is now part of baraka’s DNA.

Where do you want to be in five years?

Our mission since day one has been to empower individuals to actively invest and build their wealth – we hope that five years from now, our first users will still be using the baraka platform to do just that, while also inspiring future generations to do the same.

If you could do it all differently, what would you change?

The response to our waitlist launch has been so positive that it’s shown us there’s a definite need for a platform like baraka in the region. If we had to do it all again, knowing what we know today, we would have followed our instincts and built this platform much earlier.