Demand growth for gas in China, the world's top importer for the fuel, is set to halve because of a slowdown in activity induced by the spread of coronavirus, according to Wood Mackenzie.

Chinese demand is set to grow at a reduced pace of between 6.2 per cent and 3.6 per cent in the best and worst-case outlook respectively, following the impact of the epidemic on demand for the transitional fuel.

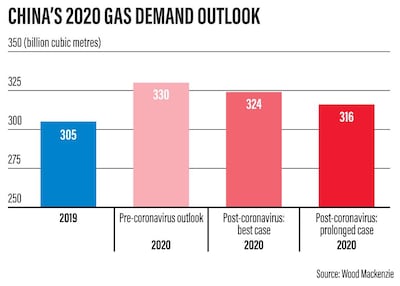

Demand for gas stood at 305 billion cubic metres last year. This was projected to grow by 8.19 per cent to 330 bcm in 2020 prior to the outbreak of the virus that has disrupted supply chains and affected market sentiments within China.

"We estimate gas demand loss in China had reached 2 bcm by the end of the first week in February, with more than half of this loss concentrated in the industrial sector," said Robert Sims, research director at Wood Mackenzie.

The coronavirus outbreak, which erupted in mid-January, has crimped demand in the world's largest importer of oil and gas. The death toll breached 1,000, with more than 40,000 infected as China resumed work after the extended Lunar New Year break. More than 60 million people remain under lockdown to contain the spread of the virus, with many international airlines cancelling flights to and from China.

Wood Mackenzie expects resumption in air travel later this month.

"With a resumption in economic activity, although limited, we estimate a full-year gas demand reduction of between 6 bcm and 14 bcm in 2020, depending on the length of time required to contain the outbreak," said Mr Sims.

Much of the disruption will be in liquefied natural gas (LNG), for which China is the world's biggest importer. The energy consultancy expects downside risks to the super-chilled gas as between 2.6 million tonnes in the best-case scenario, with recovery expected by April and 6.3 million tonnes in a more prolonged case scenario, with a slower return to normal.

Meanwhile, oil pared some of its losses during early trading on Tuesday and bounced back after touching a 13-month low as markets remained optimistic over containing the spread of coronavirus.

Brent, the European benchmark was up 1.69 per cent at $54.17 per barrel at 3.14pm UAE time, while West Texas Intermediate was also up 1.47 per cent at $50.30 per barrel.

Oil’s recent gain comes after it plunged to the lowest levels seen in over a year, as markets worried about how a rapid spread of the virus could affect demand for crude. The market remains oversupplied as demand from China, which remains under lockdown to contain the spread of the virus, has declined.

Chinese firms are said to be cutting back their refining throughput, with others declaring force majeure amid a general slowdown in industrial activity and transportation.

Markets are currently in contango, which means the near-term prices are trading at a discount to future contracts, with Brent futures at $0.2 per barrel and WTI at $0.29 per barrel over a one to two-month spread.

Lack of action from Opec+, whose technical committee recommended short-term deepening of cuts by 600,000 barrels per day, has also concerned traders.

While Oman, Iran and Bahrain have pledged to support Opec in any future action, Russia - the alliance's largest producer - has been reluctant to commit to further cuts.

The group is committed to cutting back 1.7 million bpd from the markets since January, with the pact up for review at the group's meeting in Vienna in March.

The alliance has decided against holding an emergency meeting this month to stabilise the markets.

"With no apparent Opec+ action imminent, the bias for crude prices looks lower in the short-term with a retest of $50 per barrel in Brent and $45 per barrel in WTI a possibility," said Tim Fox, head of research and chief economist at Emirates NBD.