Energy investments in the Middle East and North Africa are projected to grow 9 per cent in the next five years to more than $879 billion, as energy exporters boost spending amid higher oil revenue, according to a report by Arab Petroleum Investments Corporation (Apicorp).

The investments, which include both planned and committed investments in the region between 2022 and 2026, are up $74bn when compared with last year's estimates by the Saudi Arabia-based multilateral lender.

Saudi Arabia, Opec’s largest crude producer and the Arab world’s largest economy, is expected to lead the region in energy investments, followed by Iraq, Egypt and the UAE, Apricorp said in its Mena Energy Investment Outlook 2022-2026 report on Tuesday.

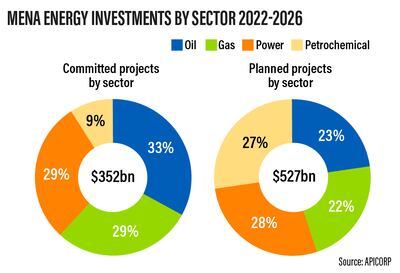

Of this, investments in committed projects — ones in execution stage — amount to $352bn, while planned projects investment total $527bn, the report said.

Countries are boosting investments in different sectors, including oil and gas, power and petrochemicals.

“Mena countries shoulder the largest share of global investments in oil and gas going forward to ensure global energy security and avoid an impending super cycle that may severely hamper the world economy,” said Ramy Al-Ashmawy, senior energy specialist at Apicorp.

“At the same time, the region continues to invest in decarbonisation, renewables and clean energy as part of the long-term strategic vision for a low-carbon future underpinned by a greener, more balanced and sustainable energy mix.”

Gulf economies are forecast to receive up to $1.4 trillion in additional revenue in the next four to five years as a result of higher oil prices and lower inflation, the International Monetary Fund said in a report last month.

Oil prices, which rose 67 per cent in 2021, rallied to a notch under $140 per barrel in March before giving up some gains. They are still up 60 per cent since last year on supply concerns amid the Russia-Ukraine conflict.

The Mena region is expected to add 5.6 gigawatts of installed capacity from renewables in 2022, from 3 gigawatts that came online in 2021, according to Apicorp. By 2026, the region is expected to add 33 gigawatts of installed capacity.

Morocco and Jordan are leading the race for achieving renewable energy targets in the region, while other countries, including Saudi Arabia, UAE, Egypt and Oman, have relatively low renewable energy generation, but they are expected to witness a “significant increase with several planned and committed large-capacity projects in the pipeline”, the report said.

The UAE, Opec's third-largest oil producer, aims to become carbon neutral by 2050, with clean and renewable energy investments worth Dh600bn ($163.5bn) planned over the next three decades.

Abu Dhabi, which accounts for the bulk of the UAE's oil production, is building the world’s largest solar plant at Al Dhafra with a capacity of 2 gigawatts, while Dubai is building the world’s largest solar energy park in an effort to reduce reliance on natural gas and diversify its power sources.

The Mohammed bin Rashid Solar Park is expected to generate 5,000 megawatts of electricity by 2030 and drive up to Dh50bn in investment.

Saudi Arabia is also building new renewable energy projects as it aims to become carbon neutral by 2060.

“Energy diversification is at the top of the agenda, with several Mena countries integrating renewables in their generation mix as part of a shared policy objective to diversify the power mix with low-cost, low-carbon energy sources and bolster power supply security,” Apicorp said.

Natural gas, a dominant fuel for power generation, is expected to grow to maintain a power generation share of about 70 to 75 per cent across Mena by 2024, the report said. Oil-fired power, on the other hand, is expected to drop from 24 per cent of total generation to around 20 per cent by 2024 amid efforts by governments to cut emissions.

Apicorp’s analysis also shows that blue and green hydrogen will dominate the emerging hydrogen markets in the near term across the region.

Blue and grey hydrogen are produced from natural gas, while green is derived from splitting water by electrolysis.

“Mena is well positioned to supply around 10 per cent to 20 per cent of the global hydrogen market by 2050, with GCC and North Africa set to become global export hubs catering for demand in Europe and South-east Asia,” the report said.

The UAE is drawing up a comprehensive road map to position itself as an exporter of hydrogen and tap into its future potential.

The Gulf country aims to capture about 25 per cent of the global hydrogen market share and is in discussions with many countries to export it, Minister of Energy and Infrastructure Suhail Al Mazrouei said earlier this year.

Last month, Adnoc, clean energy company Masdar and British energy multinational BP signed a strategic partnership agreement to develop clean hydrogen and tap into opportunities offered by the energy transition.

Green and sustainability bonds issued in the Mena region in 2021 more than tripled from the previous year to $18.64bn, the report said.