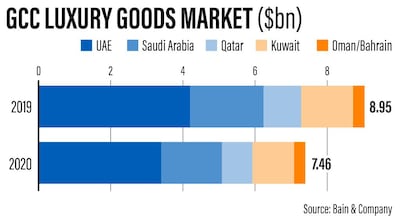

Luxury goods retailers in the Gulf will see a recovery in consumer spending in 2021, to just below pre-pandemic levels in 2019, after the market declined 17 per cent in 2020, according to Bain & Company..

Online shopping, which benefited from a massive boost during the Covid-19 pandemic, will continue to fuel growth after virus-curbing measures are removed, the management consultancy said in a report titled Assessing the Impact of 2020 on the GCC Luxury Goods Market.

"Moving forward, 2021 spending is expected to be slightly below 2019 levels, assuming a gradual return to travel in the second and third quarters," report authors Cyrille Fabre and Anne-Laure Malauzat. "Much will depend on each brand’s ability to keep a large share of the luxury spending that traditionally took place abroad while also convincing tourists to spend in the region."

The luxury goods market in the Gulf declined 17 per cent in 2020 to $7.4 billion with different countries impacted by varying degrees depending on their exposure to changes in tourism flows and repatriation of spending, the report said.

While the pandemic-induced decline in tourism hurt the market, Gulf nationals, who usually purchase 30 to 40 per cent of their luxury goods outside the region, repatriated spending in their respective countries, according to Bain.

Countries that have relatively lower foreign visitor numbers, such as Kuwait, Qatar and Saudi Arabia, recorded a lower drop than the UAE, where the impact was closer to the global average decline of 23 per cent last year.

"In the UAE especially, where tourists account for as much as 60 per cent of the luxury market, an undeniably large block of spending power was wiped out rapidly by ongoing Covid-19 travel restrictions," the authors said.

In terms of the type of luxury products, jewellery benefitted from a second-half rebound spurred by local customers, especially in Saudi Arabia, due to weddings, investment buying and the launch of new collections. Jewellery was the only luxury category to achieve value growth in 2020, albeit just a one per cent increase.

The lack of tourists weighed heavily on the watches segment, with Swiss watch exports to Gulf marketsdeclining 50 per cent in volume and 20 per cent in value.

Make-up products suffered more than fragrance but the beauty category recorded an e-commerce boom as GCC residents headed online to shop.

In terms of luxury fashion, both tourists and locals shifted their spending toward more casual day-to-day apparel, with more shopping online and top brands that focused on local customers outperforming.

Almost 70 per cent of high net-worth GCC buyers, who traditionally opt for in-store luxury shopping, now say they are comfortable with shopping online, the report said.

The switch to e-commerce during movement restrictions led several brands to report that their online sales grew by between two-fold and six-fold, Bain said.

"We anticipate that post-lockdown, e-commerce will continue to flourish as retailers and brands make large investments to improve the user experience, helping to fuel growth," the report's authors said.

Saudi Arabia, the Arab world's largest economy, will remain the biggest driver of growth for the regional luxury industry in the coming years, the company said.

The luxury market in the kingdom is changing due to several factors, including population growth, new tastes and preferences, and the emergence of new luxury consumers, such as affluent working women, the report said.

Across the Gulf, companies that invest to make the most of these trends will become the most competitive.

"The emergence of some positive shopping trends and the ongoing recovery offer hope for a return to relative normalcy in 2021 and into 2022," the authors said.