Despite a slowing global economy, impacted by the constraints of trade stand-offs, Abu Dhabi Investment Authority's (Adia) diversified portfolio of assets enabled the emirate's sovereign wealth fund to continue to weather the challenges and produce long-term returns consistent with previous years.

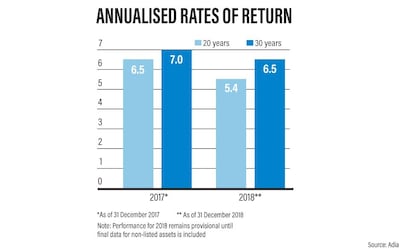

Adia, one of the biggest sovereign wealth funds in the world, said its 30-year annualised rate of return at the end of 2018 reached 6.5 per cent, while its 20-year annualised rate of return came in at 5.4 per cent last year.

The 2018 performance of the fund remains provisional until data for non-listed assets is incorporated. The fund views market performance in any given year within the broader context to assess overall trends and, on that basis, 2018 provided ample reassurance despite challenging conditions, it said in the annual review released on Monday.

“While these rolling averages [annualised rates of return] were impacted somewhat by the exclusion of strong gains in the mid to late 1980s and 1990s, Adia’s real returns remained largely consistent with previous years and historical levels,” said Sheikh Hamed bin Zayed, Adia's managing director.

However, the past decade can be viewed as a qualified success following the longest global economic expansion on record, which remained intact last year, he said.

“The world economy may not be strong and valuations of many assets are now at cyclical highs but the financial system is more robust than it was 10 years ago,” Sheikh Hamed noted.

Despite the macroeconomic headwinds last year, over the longer term Adia remains confident about the prospects of investing, particularly in emerging markets, it said in the review.

Its investment departments are focused on developing strategies to deliver enhanced returns from their simplified portfolios. The fixed income and treasury department is scaling up its active investing with a view to fully actively manage its entire portfolio in the coming years, compared with around 40 per cent currently, Adia said.

Trade tensions between the world’s two biggest economies - the US and China – coupled with Brexit uncertainty have impacted the world economic forecast this year. In April, the International Monetary Fund downgraded its global growth projection to 3.3 per cent for 2019, from 3.5 per cent it had forecast for the year in January.

That was the third time the IMF had downgraded its global outlook in the past six months. The 2019 outlook is also the weakest since the financial crisis, reflecting slowing expansion in most advanced economies.

The economic uncertainty and overhang of reciprocal trade wars also affected the global equities markets in the last quarter of 2018 with the S&P 500 and other global benchmarks recording sharp declines. The markets, however, have since paused to catch breath and both the S&P and the Dow Jones Industrial Index have touched fresh records this month on optimism of a resolution to the US-China trade dispute.

“One of the noteworthy events of last year was a broad and regrettable deterioration in trade relations,” Sheikh Hamed said. “This was not typical volatility; rather it appeared more as an inflection point in the process of globalisation that has been a tailwind for economies and markets over the past several decades.”

He said the “less hospitable international economic system” in the wake of trade disputes will result in new challenges but it will also provide ample opportunities to global long-term investors.

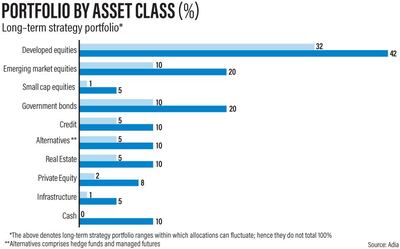

Adia, which does not disclose its assets, is the third-biggest fund - after Norway and China - that invests on behalf of the Abu Dhabi government, according to the Sovereign Wealth Fund Institute. It holds directly, or through its subsidiaries, investments across various asset classes including equities, fixed income, real estate and private equity.

Adia is optimistic about the long-term growth prospects of the global economy, which the IMF said is expected to plateau at 3.6 per cent in the medium term - sustained by growth in economies such China and India that will outpace the expansion of advanced and emerging market economies.

“Looking ahead, it appears likely that global growth will remain stable for the foreseeable future, although contributions will be spread unequally between countries,” Sheikh Hamed said.

“Demographic trends continue to favour emerging over developed economies, with India and China in particular expected to remain important engines of growth.”

Adia will continue to seek opportunities to invest in these higher growth markets, alongside local partners in sectors that are closely aligned with the growth priorities of their respective governments, it said in the review.

In terms of the global equities outlook, the fund said markets appear “finely poised”. Despite a sharp recovery in the early months of 2019, doubts remain about the sustainability of earnings growth at a time of record high profit margins and signs of a slowing global economy, the fund noted.

After experiencing considerable volatility last year, emerging markets' debt may begin to look attractive if conditions stabilise this year. The credit markets may come under growing pressure in 2019 against an increasingly complex geopolitical backdrop, it added.

Adia, however, remains optimistic about investments in the real estate sector, which accounts for between 5 per cent and 10 per cent of its portfolio.

“As 2019 began, real estate market fundamentals remained well supported, as the weight of capital seeking quality investment returns continued to grow,” Adia said in the review, adding that as in 2018, its real estate team will seek to balance portfolio and asset management with “selective acquisitions in areas with long-term growth potential”.