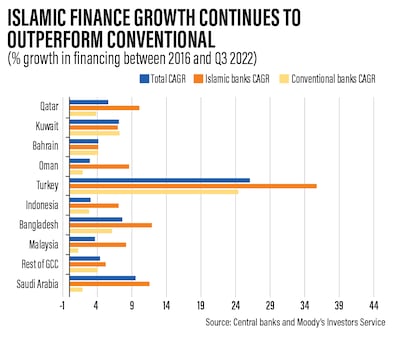

Demand for Sharia-compliant financing is set to outpace conventional funding in 2023, driven by strong economic growth and development agendas in key markets including Saudi Arabia amid higher oil prices, Moody’s Investors Service has said.

Global sukuk issuance this year is forecast to “level off” in the range of $170 billion to $175 billion in 2023, supported by sovereign financing needs in key Asian markets of Malaysia and Indonesia and resilient demand from banking and corporate sectors, Moody’s said in a research note on Wednesday.

The levelling off of sukuk volumes follows a 10 per cent fall in 2022 to $178 billion given lower funding requirements from the six-member economic bloc of GCC region and South-east Asian markets.

“We expect Islamic banking in key markets to keep growing faster than conventional peers supported by robust economic activity in South-east Asia and the GCC region,” Ashraf Madani, vice president and senior credit officer at Moody’s, said.

“This will be driven by high commodity prices and governments' economic diversification agendas; sovereigns’ continued backing and promotion of the Islamic finance industry and growing demand for Sharia-compliant products.”

Although Saudi Arabia, the biggest Arab economy and the Opec’s leading oil exporter, and Malaysia will continue to lead sukuk issuances, the potential for growth in other jurisdictions also remains high, he said.

Long-term sovereign sukuk issuance will also stabilise in 2023 after two years of declines at around $80 billion level, before rising to around $80 billion to $85 billion in 2024.

The levelling off of global long-term sovereign sukuk issuance volumes at around last year's level follows the declining trend since the all-time high hit in 2020.

Issuance volumes fell 22 per cent to $80 billion in 2022 as significantly higher energy-related government revenue pushed fiscal deficits into surpluses for most GCC sovereigns and helped reduce fiscal deficits in Malaysia and Indonesia.

The post-pandemic economic recovery also supported stronger fiscal performance, which slashed the net financing needs of major sukuk-issuing governments.

Malaysia, Indonesia and Turkey are expected to be the largest sovereign issuers this year and next, Moody’s said in a separate report.

Supportive hydrocarbon prices continue to bolster fiscal balances of energy-exporting sovereign sukuk issuers. With most GCC sovereigns still recording budget surpluses this year and in 2024, Moody’s expects their issuances to be mainly driven by the need to either refinance or repay maturing sukuk.

“We expect significantly lower gross issuance from GCC to be broadly offset by higher volumes elsewhere, particularly in Indonesia, where domestic sukuk issuance dipped significantly in 2022,” Alexander Perjessy, senior credit officer at Moody’s, said.

Oil prices that surged more than 60 per cent in 2021, continued the upwards momentum in 2022. The wild swings triggered by Russia’s assault on Ukraine that pushed Brent to a notch under $140 per barrel settled towards the end of last year and the benchmark for two thirds of the world’s closed 2022 at about $80 per barrel mark.

It is still trading at more than $83 a barrel level, which supports the budgets of energy-exporting nations of the Gulf region. Continuing current account surpluses also give GCC sovereigns the financial muscle to implement their development agendas, which they are partly funding through a combination of conventional and Islamic financing.

Despite lower funding requirements in 2022, GCC countries, along with Malaysia and Indonesia, remained the largest issuers of sovereign sukuk. Together they accounted for 77 per cent of total long-term gross sovereign sukuk issuance and 87 per cent of outstanding long-term sovereign sukuk issuance at the end of last year, according to Moody’s data.

Within the GCC, Saudi Arabia was the single largest issuer since the launch of its domestic riyal-denominated sukuk issuance programme in 2017, accounting for 78 per cent of outstanding government sukuk sold in the region and 34 per cent of government sukuk issued globally.

“Malaysia, Indonesia and Turkey were the next three largest sovereign issuers in 2022, with market shares of 25 per cent, 19 per cent and 5 per cent, respectively,” Moody’s analysts said.