European plane maker Airbus followed its US counterpart Boeing in suspending sale of parts and support services to airline customers in Russia.

This comes as the impact of economic sanctions on Moscow over its military offensive in Ukraine reverberates through the global aviation industry.

"In line with international sanctions now in place, Airbus has suspended support services to Russian airlines, as well as the supply of spare parts to the country," an Airbus spokesman said on Wednesday.

"As always, we comply with all export control regulations and applicable laws."

The Toulouse-based company said it was closely monitoring the situation along with its customers and suppliers. It expressed concern about the security situation "deteriorating so rapidly in Europe", but said that it was "premature" to comment about the impact of sanctions on the industry.

Meanwhile, Chicago-based Boeing, which has long-term partnerships with Russia in areas of aviation, metallurgy, space, engineering and information technology, has also taken similar measures.

"We have suspended major operations in Moscow and temporarily closed our office in Kyiv. We are also suspending parts, maintenance and technical support services for Russian airlines," a Boeing spokeswoman said.

"As the conflict continues, our teams are focused on ensuring the safety of our teammates in the region."

More than a dozen countries have banned Aeroflot and Russian-owned or chartered jets from their airspace, while the European Commission moved to prohibit the sale of parts and services to Russian airlines.

"We are making it impossible for Russia to … repair and modernise its air fleet; and to access many important technologies it needs to build a prosperous future," Ursula von der Leyen, President of the European Commission, said on Tuesday.

"We have closed our skies to Russian aircraft, including the private jets of oligarchs."

The latest moves will leave Russia's commercial aviation sector increasingly disconnected and isolated from the global industry, which will have a major impact given its dependence on western suppliers, analysts say.

"Russian fleets have been largely rejuvenated using western aircraft over the past several decades. As the numbers of Iluyshins and Tupolevs fade, Airbus and Boeing jetliners fill the void," George Ferguson, senior aerospace analyst at Bloomberg Intelligence, said.

"The most produced Russian plane in recent times is the regional Sukhoi Superjet 100, sized at about 100 seats, but it's had reliability issues."

Sanctions would ultimately hurt Russian airlines' ability to maintain fleets, he said.

"Most challenging would be engine components, with the largest power-plants in service built by CFM (the GE-Safran joint venture) for Boeing 737s and Airbus A320s, and the V2500 (on A320s) from the Raytheon Technologies (Pratt and Whitney) and MTU joint venture," Mr Ferguson said.

Boeing's 737 Max deliveries could be "hamstrung" after sanctions, as the plane comprises the majority of the Russian airlines' order book, and deliveries have been suspended while awaiting regulator approval to operate again, Mr Ferguson said, following a ban on the jet model after two fatal accidents.

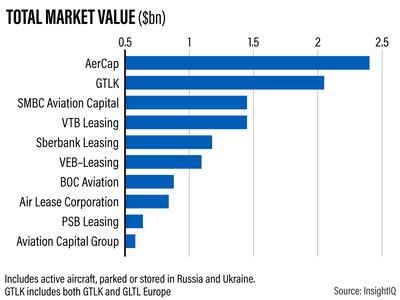

More than half of the active commercial aircraft fleet based in Russia are leased aircraft, many of which are managed by lessors based outside the Russian Federation, consultancy IBA said in a report examining which aircraft leasing companies were likely to be most at risk as a result of the conflict and ongoing sanctions.

"AerCap is likely to be the most exposed to hard-hitting economic sanctions, with 152 active, parked and stored aircraft across Russia and Ukraine," IBA said.

"This high number of aircraft is largely driven by AerCap’s acquisition of GECAS in late 2021."

Russian state leasing company GTLK has the second-largest fleet of aircraft hit by the sanctions, which is made up of a mix of commercial jets and helicopters. The GTLK fleet includes the Russian-built Sukhoi Superjet 100 regional airliner. Sanctions against VEB Leasing were announced by Washington in 2020, joining existing sanctions from the UK.

Airbus and Boeing are also among a growing list of western companies ranging from Apple and Exxon Mobil to BP, Shell and Norway's Equinor ASA that have halted business or announced plans to abandon their Russia operations.

The punitive measures by the US and EU have hit Russian economy hard. But they have not placed sanctions on Russia’s energy and commodity industries, which are integral to the global economy. Russia is among the world's biggest producers of oil and natural gas, in addition to nickel, aluminium, palladium, cobalt, copper, wheat and barley.