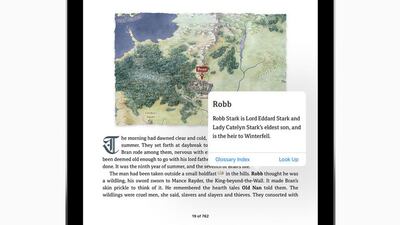

Few e-books outside of the children’s market have really taken advantage of the potential of the format to offer readers more than just a digital copy of the print version. But if there’s one book that might start to change all that, it’s George R R Martin’s Game of Thrones Enhanced Edition, which is exclusive to Apple’s iBooks service. Launched at the end of last week, it includes clickable maps, additional biographical information about the characters, detailed annotations, illustrations, family trees and audio clips. Basically, it makes the complex world of Westeros and the huge cast of characters who populate it much more accessible – and with the added bonus of an exclusive extract from the long-awaited sixth book in the series, The Winds of Winter, it’s no surprise it’s already riding high in the digital charts. Enhanced versions of the other volumes are also planned. You can watch a trailer for the enhanced edition and an interview with Martin about it on YouTube.

Book review: A new way to explore Westeros

Most popular today