It's not just hot in Khalifa Park - it is searingly, confusingly hot right now. And the park is predictably deserted, as its concrete concourse is baking in the midday sun. A lone golf cart appears to quiver in the heat haze. The toy train that tours the perimeter of the park has ground to a dusty halt. The merry-go-round looks like it could melt at any moment. But dip into the air-conditioned gusts of Khalifa Park Maritime Museum and discover one of Abu Dhabi's true hidden curiosities - a subterranean ride that tells the story of the emirate via sound, speech and a legion of smiling waxworks.

What the 'Time Tunnel' is

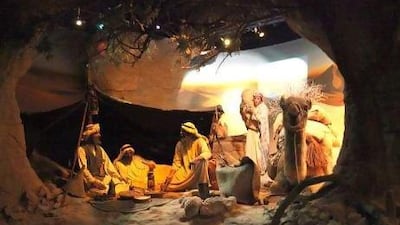

The journey lasts about 20 minutes, and the pod-like car may not go fast nor upside down, but it does chart the history of the country from its pre-Union days through to the present in a lively way. Animatronic waxworks of Emiratis wave, weave clothes and welcome visitors as the car passes through the largely nomadic days of the country - looking at how livelihoods were made and bellies filled in one of the harshest environments on earth. A fairly detailed voice-over is interspersed with occasionally incomprehensible conversations among some of the waxworks that you trundle past.

Where you can find it

That's the thing - the Time Tunnel is so weirdly hidden away in the back of the Maritime Museum that you'd be forgiven for never spotting it. The museum itself opens on to a confusing space that looks like a school room, presided over by a waxwork Emirati leading a class and discussing slides. Behind a dark curtain is the entrance to the Time Tunnel, but make sure to get one of the guys on reception to switch it on, and tell them whether you want it in English or Arabic.

Why you should go

Entertainment during these toastier months is hard to come by at the best of times. So the opportunity to sit back and get an accessible education on the bygone days before the Union, as well as coming face to face with a small army of slightly unnerving waxworks - all for a mere Dh3 - is certainly worth a quick trip to Khalifa Park.

What you can expect

After the early history of the UAE, your pod is whisked through a fairly impressive aquarium, showing off some of the species local waters are home to. It then charts the demise of the pearl-fishing industry, heralded by a rather epic flaming oil derrick on a hand-painted background of the sea. The development of the oil industry is described, with a nostalgic reflection on those old divers who swapped their nose clips for overalls and helped in the construction of the early offshore platforms. The tour culminates in a rousing call for the founding vision of the country to continue into the future; as well as a scale model of an Abu Dhabi street (featuring a surprising number of pedestrians).

If it sounds like it's for kids …

It is! But that's not to say it isn't engaging for adults as well (as a bonus, the Desert Garden Centre is just next door). With Abu Dhabi's big museum projects still on their way, this is a snappy exhibit with a wanderable aquarium, all done in an engaging multimedia fashion.

The Time Tunnel in Khalifa Park's Maritime Museum is open from 8am to 10pm Sundays to Thursdays and 11am to 11pm on Fridays. Entry is Dh3