Iceland, a small, rocky outpost in the North Atlantic and home to just over 318,000 people, is not a country that easily makes international headlines. Back in the 1970s, Iceland was a staple feature of the nightly news, in the UK at least, as the country's small navy did its best to repulse British fishing vessels in what became known as the "Cod War". More recently, Iceland hit the headlines as the country went bankrupt, the first casualty of the second Wall Street crash.

Iceland, which had prided itself as being one of the most egalitarian societies in the world, had moved rapidly to deregulate and privatise its economy in a bid to boost investment and expand its burgeoning banking sector. This was back in the 1990s, and by the millennium, the Icelandic government had largely deregulated and privatised its banks, thus opening the way to a massive expansion of the financial sector.

As with Ireland and her soaraway "Tiger economy", there seemed no end to the years of boom. Bust was unthinkable for a small island nation, which is part of the European Union. The economic cycle of "boom and bust" appeared to have been abolished.

Perhaps in some small way the Icelandic experience had come to feature in the thoughts of the former chairman of the US Federal Reserve, Alan Greenspan, and his early disciple, the former British chancellor and prime minister, Gordon Brown. They truly believed that boom and bust had been abolished through a marvel known to them as "endogenous growth theory". Endogenous growth, centred around a booming service, software, banking and housing sector, would be the motor for permanent economic growth.

And then in 2008, Lehman Brothers fatefully went belly up, as did that other banking giant, AIG. The keenest effect of the sharp wind blowing in from Wall Street was felt in Iceland's now horribly exposed banking sector. The credit squeeze virtually wiped out the country's banking sector, presaging an enormous economic slump. Back then, living and working in New York, I remember American friends deciding on Iceland as a cheap holiday destination the following year. But for ordinary Icelanders, life for perhaps the first time in a long time became difficult and hard. Old certainties shrivelled along with the jobs and the easy lifestyle of a country that prided itself in its cradle-to-grave welfare system.

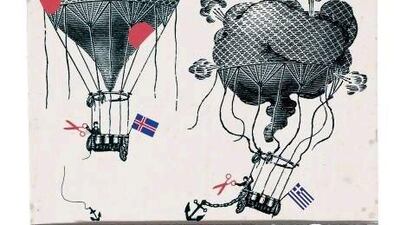

The country's leaders were obliged to go on bended knee to the International Monetary Fund (IMF) for a US$2.1 billion (Dh7.7bn) support programme, and then slowly and quietly Iceland faded from international view, as the contagion spread to Ireland, to Greece and to the rest of the European Union.

But this week something happened that put Iceland back on the front pages again. The country's credit ratings were upgraded from near worthless junk bond status to investment status by the ratings agency, Fitch. In upgrading the country's economy from BB+ to BBB "with a stable outlook", the agency said that the country's "unorthodox crisis policy response has succeeded". As Iceland's bouffant-haired prime minister, Johanna Sigurdardottir, waved and beamed to the cameras, Tamerlan Khassimikov, of BST Capital Management, added: "A major part of Iceland's debt has been written off. That means the country has more chances to pay its debts. So Iceland's bonds are more attractive to investors than those of Greece or Portugal."

Mr Khassimikov's words were no sooner out of his mouth before some sage observers began to speculate that the Icelandic economic recovery could provide both lessons and hope for countries such as Greece, which this week announced yet deeper austerity measures in return for a second euro bailout, a bailout that many observers believe buys time for others such as Portugal and Italy but, without economic growth, little else.

On closer examination, however, the Icelandic experience is one that cannot easily be replicated. For a start the country was not a member of the euro zone and was able to devalue its currency, the krona. No euro-zone country has that same massive room for manoeuvre, unless of course it defaults and exits the euro zone. More than that, when its banks collapsed, the Icelandic authorities simply let them go to the wall - and then renationalised them. Shareholders and depositors lost heavily as did a range of outside investors, such as local authorities and pension funds from countries such as the Netherlands and Britain.

John Stevens, a former member of the European parliament and before that a banker, said: "Iceland has a population the size of an English Midlands town such as Nottingham, where total capitalisation of banks was about 20 per cent of GDP. This compares with 5.7 per cent in the UK, 1 per cent in the US and 0.5 per cent in Germany and France. Iceland simply closed her banks and refused to pay. In Britain, we bailed out the banks after they had lost £100 billion [Dh576bn], doubling our national debt. We couldn't do it again."

When I sought some answers from senior analysts over at Citibank, as to what lessons Iceland's recovery might have for the wider euro zone, no one was prepared to speak on the record. Off the record, one analyst said: "The Icelandic experience is difficult to replicate in the euro zone."

In the words of Iceland's long-serving president, Olafur Ragnar Grimsson: "We followed the will of the people. For in Europe there is a conflict between the democratic will of the people and the financial markets." Put bluntly, Iceland has bankrupted its way to recovery. More than that, its solid economic fisheries and manufacturing base have put real value back into the krona. In fact, the more one studies the Icelandic experience, the more even a detached observer must conclude that a small individual state has been able to use levers of economic and political power that are denied within the euro zone.

Some might argue that Iceland's political leaders have acted in an altogether old-fashioned, Keynesian way, frowned upon by the neoliberal orthodoxies that have held sway for so long. Yet without that IMF loan, it would all have been so different. And despite the recovery under way, about 25,000 Icelanders are still in arrears with their mortgages.

Greece's deep malaise doesn't lie so much in a banking crisis. The country doesn't have much of an international banking sector, but more that, it joined the European single currency decades before it should. The country's monied elite have largely hidden their wealth offshore and avoid paying taxes, while Greece's public sector is bloated by political patronage and cronyism of the worst order. According to John Stevens again: "If Greece - and Italy for that matter - can give up their patronage system and the old cronyism is finally broken, they have sound economies underneath. There are signs that this may at last be beginning to happen."

If there are any lessons for Europe as a whole, it is that there is no easy route to recovery. Iceland's path was unusual and isolated, but economic growth is just as important there as it is to faltering members of the euro zone. The European political class and the bankers who heaved their shoulders in relief at the latest Greek bailout may soon have to accept that part of the answer lies with everyone paying taxes - not just the little people - that those taxes should be progressive and probably fall heavier on those who can afford them. Progressive taxation, a financial transaction tax and an acceptance of the necessity of euro bonds may be part of the longer term solution, too.

Mark Seddon is the former UN Correspondent for Al Jazeera English TV. His latest book, Standing for Something, is a memoir of life in the Labour Party under Tony Blair

If Iceland can beat the big chill, will Greece now take the heat?

Last week, financial crisis-humbled Iceland saw its international credit rating raised once more to investor status. So what are the lessons for Greece and the other troubled members of the euro zone?

Most popular today

9