I read each of these books more than three years ago, but I still remember how they moved me, and gave me an insight into what our region was like, spanning from post-Colonial-era Sudan, to when the Portuguese dominated the Arabian Peninsula.

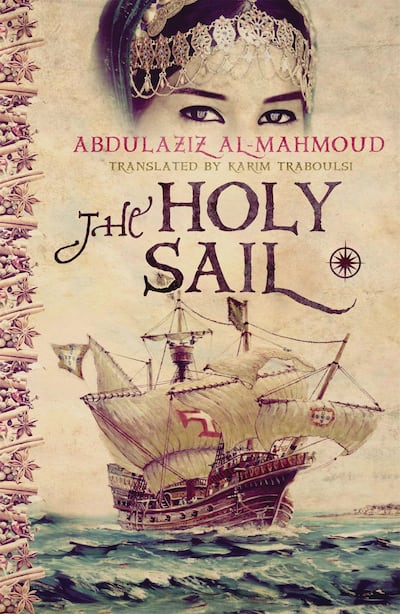

'The Holy Sail' by Abdulaziz Al Mahmoud (2015)

With every page I turned, I felt my eyes were opened to the neglected history of the Portuguese invasion that took place partially in Khor Fakkan – where I now go on holiday. This novel explains how this invasion started and what motivated it, and includes scenes set in Cairo, Jeddah, Aden, Muscat and Al-Ahsa, as well as telling of a young woman’s struggles with love and honour.

'Season of Migration to the North' by Tayeb Salih (1969)

I remember hating the idea of colonial rule after reading this, and how it can leave your identity in crisis. The story – which follows an unnamed narrator, who leaves Britain to return to his small Sudanese village on the Nile, and villager Mustafa Sa’eed – has been described as “the most important Arabic novel of the 20th century”, and is filled with symbolic references to the East and West.

'I Saw Ramallah' by Mourid Barghouti (2000)

I read as a child. I was so immersed in it that I experienced every feeling that Barghouti described as he recounted his return to his village for the first time in 30 years. It was as though I was the Palestinian grappling with ideas of home and displacement. The author writes, “The long occupation has changed us from children of Palestine to children of the idea of Palestine.”

'The Bamboo Stalk' by Saud Alsanousi (2015)

When I read this novel as part of my university studies, little did I know that it would change how I looked at foreign workers in the Gulf. Alsanousi simply moved me; from the first page, I was struck by the author’s innovation. This novel was adapted into a TV show, Saq Al Bamboo, and highlights social issues in Kuwait, such as racism and the stateless Bidoon.

'The Handsome Jew' by Ali Al Muqri (2009)

This is the only book on this list that wasn’t translated into English, but I included it because, as a believer in cross-cultural and cross-faith marriages, the story of Muslim girl Fatimah falling in love with Jewish boy Salem was so relatable. This book is a window into the little-known history of Jews in Yemen in different eras. Al Muqri never fails, in any of his novels, to shed light on minorities in thought-provoking ways.

_________________

Read more:

'Celestial Bodies' shines a light on Omani literature

Syrian playwright Saadallah Wannous can still reach his audiences two decades after his death

Key UAE figures share their favourite reads in social media challenge

_________________