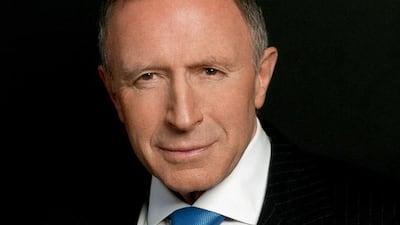

The first jeweller to be presented with the Queen’s Award to Industry for his services to jewellery, Laurence Graff founded Graff Diamonds in 1960. Under his leadership, the company has handled some of the most important gemstones in the world – including the 118.88-carat Graff Venus. He is also an avid collector of art, and is on the board for museums such as the Guggenheim in New York and the Tate Modern in London. The British businessman currently resides in Gstaad, Switzerland

If you could wake up anywhere in the world tomorrow, where would you be?

At the Delaire Graff Estate in South Africa. I have a personal affinity with Africa and have done so for many years. In 2003, I had the chance of acquiring the Delaire Graff Estate, a true gem, nestled between majestic mountains and overlooking the vineyards of Stellenbosch.

Your perfect meal: Where are you, whom are you with and what are you eating?

On the terrace at the Delaire Graff Estate, overlooking a sea of vineyards and olive groves with my family, while eating a fresh seasonal dish.

when did you first fall in love with gems?

I have been passionate about diamonds from a young age. When I was 15, I worked as an apprentice in a small jewellery shop in Hatton Garden, while taking classes at Central School of Arts and Crafts. I remember spending hours looking at gemstones. They fascinated and captivated me, and without realising it I became a self-taught gemmologist. It was an inherent feeling that has turned into a lifelong passion.

Where does the allure of the diamond lie?

I am drawn to stones. I just want to touch the gems all the time, and feel them and look at them. I get a thrill every morning when I open a package and look at a diamond, or at a piece of rough that gleams, that has life, that we’re going to cut to give birth to a stone. Our business is about emotions; it’s being able to see into the heart of a stone and to connect with its possibilities.

You've made it your mission to secure some of the most important stones in the world. Are there any you regret losing out on?

My only regret is selling a diamond and seeing it go. We take great pride and responsibility in knowing that these gems of everlasting beauty will pass from generation to generation, taking their place in diamond history.

You have amassed a world-class collection of art. What kind of art do you respond to?

I collect modern art and my collection includes an array of artists: Andy Warhol, Pablo Picasso and Francis Bacon, among others. When buying art, I use my skill, expertise and own judgement. I don’t find someone to advise me.

Do you collect anything else?

My son, François, has been a classic-car aficionado for many years, and he recently ignited my interest in this area. I am sure that I will continue to add to my collection.

What was your first-ever luxury purchase?

Acquiring the finest quality stones has always been important to me, as is taking risks when the opportunity presents itself. I started from a tiny, tiny room, and I took an older man as my partner. He was the craftsman; I was the salesman. It was a twosome. We sold pieces for two or three pounds each. The rings were made with semi-precious stones, and they were handcrafted. I managed to get credit to buy some diamonds, and I sold a ring for £100. That was basically how it started. And then I sold a ring for £200, then £500.

What does luxury mean to you?

I love to be surrounded by beautiful things, and I love to work with the best, whether with my diamonds or my art.

What, to you, is the most overrated luxury?

Anything that’s fashionable can become unfashionable. So one has to watch that. Don’t try to buy as an investment. Buy something you really love because you’re going to have to look at it again tomorrow. Buy something you want to live with. If you decide some years later you don’t want to live with it anymore, sell it.

What's the most important lesson you've learnt over the years?

To always be honest, always be correct. It is something I learnt from my elders years ago and these values have shaped my own career.

Read this and more stories in Luxury magazine, out with The National on Thursday, April 13.

sdenman@thenational.ae