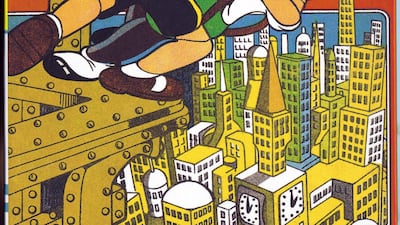

On June 30, 1880, Japanese artist Kawanabe Kyosai went into a photography studio in Tokyo, downed a beverage and began painting with a hemp broom. Four hours later, he had painted a 17-metre curtain for the city's new Shintomi Theatre. The curtain, lined with psychedelic demons and monsters, would later go on to to play a significant role in inspiring the manga movement in Japan, now one of the most popular art forms in the world.

The curtain is on display in a new exhibition at London's British Museum, called The Citi exhibition Manga, which opens its doors to the public on May 23.

The original translation for manga is actually "pictures run riot", associated with the 19th century Japanese artist Katsushika Hokusai, whose drawings of people, animals and nature were published as "Hokusai manga". Since then, the art form has evolved into immersive graphic storytelling and has become a global phenomenon, with the industry turning over £3 billion (Dh14 billion) in 2016.

Originally only popular in Japan, manga has since featured in comics, newspapers, television, gaming, ceramics and even in the Japanese Foreign Office. The exhibition has examples of manga showcased on all of those platforms.

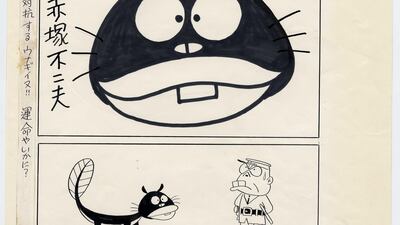

The exhibition includes 162 works by many leading manga artists, including Osamu Tezuka (Astro Boy and Princess Knight), Toriyama Akira (Dragon Ball) and Fumiyo Kono (Gigatown), among others.

Western favourites, such as films Spirited Away and The Wind Rises by Japanese animator Studio Ghibli, also feature in the exhibition.

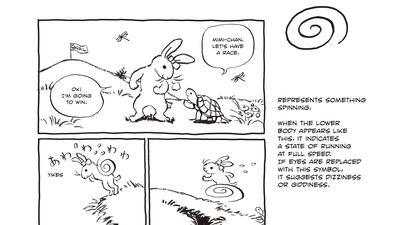

The exhibition is divided into six parts, the first going into detail about understanding manga through reading, drawing and producing it. Other aspects of the exhibition focus on the history of manga, different styles of storytelling, manga in society and expanding the genre’s boundaries.

According to exhibition curator Nicole Coolidge Rousanmiere, the art form "has always been edgy" and is often used to "tell stories in visceral ways".

"Manga is a type of storytelling mostly for those whose stories haven't been told," she says, speaking at a preview of the event.

Often stories can be political, controversial and relate to emotional struggle. Themes explored in the exhibition works include sexuality, the Rugby World Cup, the Hiroshima bombings and the 2011 Tōhoku earthquake and tsunami.

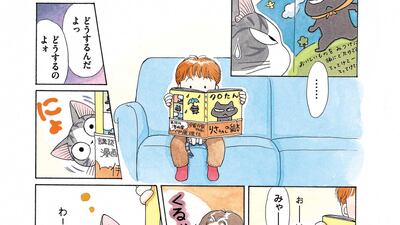

Other works in the exhibition focus on gender identity. One example is Prince Jellyfish (Kuragehime), a manga series primarily for women, written and illustrated by female artist Akiko Higashimura. The series explores gender and identity through a fictional apartment in Tokyo where only female tenants are allowed.

Higashimura is part of a group of female manga artists that pioneered the Shojo manga movement in the 1970s – which is aimed at a female teenage audience. In Japanese 少女 (shōjo) means "young woman".

But today, a major impact on manga and all of its sub genres, is digitalisation.

Although manga was originally hand-drawn, now approximately 50 per cent of it is drawn digitally on tablets, says Rousanmiere.

Another change in the manga world is that traditional stores that sell the art are closing down. At the centre of the exhibition, there is a rendering of the oldest manga shop in Tokyo, which closed in March 2019.

“Many people have been changing their style from analogue to digital and they’re now publishing very quickly. There are more independent comics – Comiket (the not-for-profit manga convention in Tokyo) is getting bigger – so many things are changing,” Gengoroh Tagame, a manga artist attending the exhibition, says.

Tagame hopes the exhibition will lead to more people understanding the art form internationally. The event looks to immerse its visitors through art work, video and audio interviews with manga artists and editors.

“In manga, the art shows the action before something happens and the aftermath, but it often doesn’t show the point of contact or fall. It does this to engage the imagination,” says Rousanmiere.

“It’s something about the engagement that makes manga special."