Two young artists, one from UAE and one from India went on display yesterday in Dubai's Al Quoz district.

Shaikha Al Mazrou's work makes use of electronic waste such as computer circuit boards and desk-top housing to create geometric forms that challenge the viewer to appreciate colour harmony in a different context.

Here she has created a perfect square from computer housing that hangs from the gallery wall and brings into references many of the great art masters that came before her.

In another piece, she uses vinyl sheets to create tactile forms such as a circular donut and that of a pregnant woman.

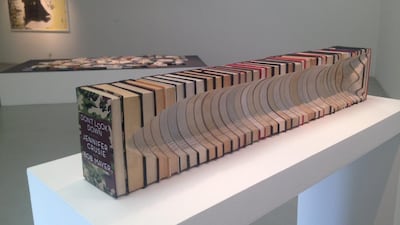

Biju Joze's work is quite differently informed but there is a dialogue between the two. In

Agni II

, he has carved the shape of an intermediate-range ballistic missile into a tightly packed row of books. The lack of the missile's presence is a way of showing a "non-violent approach", he explains and the choice of the book

Don’t Look Down

at the end of the sculpture suggests a warning not to look at the aftermath of destruction.

Joze also works with round vinyl stickers, or hole guards to create a series of images that, thanks to the chosen medium, resemble pixelated forms and so play nicely with the electronical items in Al Mazrou's work.

“Since we started this collaboration between the two galleries we have been trying to create a dialogue between artists from Dubai and different regions," explains Malini Gulrajani, director of 1x1. "I believe art should move beyond geographical boundaries and my association with Empty10 has helped me pursue this direction. We felt there was a great connection between the works of these two promising young artists and felt it would create an interesting exchange."

* Biju Joze and Shaikha Al Mazrou will run at Empty 10 and 1x1 until March 10