No rest for Premier League players this week with a slate of midweek fixtures. Thomas Woods picks the scores of each match. Click or swipe through for more.

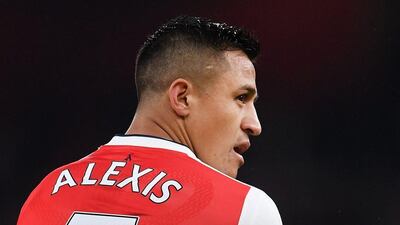

Everton 0 Arsenal 1

Arsenal fans may be growing concerned by the amount of football Alexis Sanchez is playing at the moment, but then how can manager Arsene Wenger rest him when he is in such good form? Arsenal are on a roll going into the Christmas period, Everton aren’t. Away win.

Bournemouth 1 Leicester City 2

Claudio Ranieri’s squad rotation could pay off for once, with Leicester having more resources to give players a break. Bournemouth have shown they can be a match for any team on their day, but are hardly rock solid at the back, and Leicester have just put four past Manchester City.

Middlesbrough 1 Liverpool 1

This feels like a banana skin for Liverpool. The short turnaround this week will catch some teams off guard. Liverpool take on one of the better defences in the bottom half of the table and this could be a match where the absence of injured Philippe Coutinho shows itself in a lack of spark up front.

Sunderland 1 Chelsea 4

Sunderland have had some good results recently, but Saturday’s 3-0 defeat at Swansea City showed that their defence is far from solid. Swansea’s Spanish striker Fernando Llorente found plenty of space against Sunderland’s centre-backs and Chelsea have a much better striker in Diego Costa. He will find the net.

West Ham United 3 Burnley 1

This is must-win for West Ham and they will come good at home. Burnley are still without a league victory on the road, they have scored just once and let in 15. As long as West Ham’s forward players perform to their potential, this is three home points.

Manchester City 2 Watford 1

City need a convincing win after their shambolic defensive display in the 4-2 defeat at Leicester. They won’t get that, but they will get three points. Watford beat Everton 3-2 on Saturday but their defence gave up quite a few chances, enough to suggest City will cut through them. The home side only have two clean sheets all season though, so expect Watford to score.

Stoke City 1 Southampton 0

The visitors will be hurt by the absence of top scorer Charlie Austin. He is set to miss three months and this could result in a slump in form for Claude Puel’s side. In a tight game, home advantage will be the deciding factor.

Tottenham Hotspur 3 Hull City 1

Despite losing 1-0 at Manchester United on Sunday, Spurs performed pretty well. Their passing in particular was concise and they dominated United at times. Against Hull they should be able to do as they please. Dele Alli got into some fine positions between midfield and defence and he could be a key player.

West Bromwich Albion 3 Swansea City 1

Tony Pulis has managed to add attacking quality to and already rock-solid defence to turn West Brom into contenders for a European spot. Even though Swansea are slowly improving, their defence isn’t good enough to hold Salomon Rondon and Matty Phillips at bay.

Crystal Palace 0 Manchester United 2

Palace have been among the goals — 10 in their last three games — but United have the weapons to keep them at bay. Eric Bailly against Palace striker Christian Benteke is going to be an enthralling battle, as is whoever plays at left-back for United against the in-form Wilfried Zaha.

Follow us on Twitter @NatSportUAE

Like us on Facebook at facebook.com/TheNationalSport