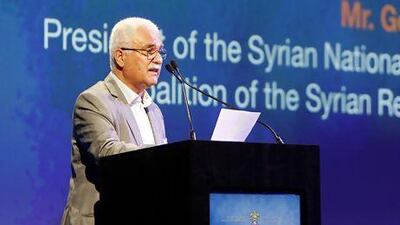

George Sabra, the head of Syria's main opposition body in exile, made a plea to allied nations to provide as much as US$60 billion (Dh220.3bn) to rebuild the country in the event of the president Bashar Al Assad being removed from power.

"We will be asking for loans at a later stage from the Friends of Syria and the international community. Syria is a founding member of the Arab League and they have a duty to help it," said Mr Sabra, the head of the Syrian National Council (SNC).

About $60bn is needed to rebuild the country which will also need other forms of assistance “within the first six months” of any new regime, he said.

The SNC is one of the groups within the National Coalition for Syrian Revolutionary and Opposition Forces that was ratified this month and recognised by Arabian Gulf countries, France, Italy and the United Kingdom.

About 400 Syrian businessmen attended the Partnership to Invest in Future Syria conference held in Dubai, said Ayman Tabbaa, the chairman of Syrian Economic Forum, a think tank.

“The government says there is $80bn held in bank accounts for Syrian businessmen outside the country,” said Mr Tabbaa. “We are definitely counting on these people to come back and invest in Syria. But to do that, we will need legal reform to encourage smart money to come back.”

Volkmar Wenzel, the German ambassador and personal representative of the Federal Foreign Minister for the Arab World, said the $60bn figure was accurate, but questions remain whether any new government would be able to implement the reconstruction efforts instantly.

“We know from experience that matters of reconstruction and its implementation takes time,” said Mr Wenzel, who also served as the German ambassador to Damascus from 2005 to 2008.

A 20-month uprising along with sanctions on its mainstay oil sector has taken a toll on Syria’s economy. Businesses are struggling to secure letters of credit to import goods from abroad, causing the cost of their products to rise.

Syria’s 14 private lenders, considered the crown jewels of Mr Al Assad’s economic modernisation plan, are also struggling with a mismatch of assets and liabilities following an almost 50 per cent decline in the value for the country’s currency last year amid a violent crackdown spurred by civil unrest.

Lenders have slipped into the red for the first time since the crisis, third-quarter results show. Many banks reported a windfall of profit in the third quarter of last year, despite international sanctions, because of their foreign currency holdings.

Some branches are unable to stay open every weekday. Others have closed completely, and managers have transferred their staff to branches operating in safer neighbourhoods.

The IMF has not provided figures on the Syrian economy since the outbreak of violence.

The Damascus exchange index has lost more than 40 per cent of its value since the uprising. Trading has mostly halted over the past month, although the exchange remains open.

The dollar is worth 70 pounds (Dh3.64), a record compared to 47 pounds before the crisis last year. In the black market, the greenback trades at 85 pounds.

“We have a country that has been ruined, that has been bombed,” said Mr Tabbaa. “We are going to need a lot of support to rebuild the infrastructure. To put the trust back into the Syrian pound. We will need to build everything from scratch, everything that has been ruined.”

The central bank is ready to intervene and pump millions of dollars to save the banks and is fully committed to funding commercial requirements through the banks, Syria’s state news agency Sana cited the central bank governor Adib Mayaleh as saying.