The Saudi capital is set to light up with the works of 60 artists from 20 countries this weekend, as the Noor Riyadh festival begins on Thursday.

This annual lights and arts event will feature installations and galleries spread across 13 locations in its first year and will continue until April 3.

"This is what makes Noor Riyadh different from any other light festival; it is not centred in one area," festival director Miguel Blanco-Carrasco told The National.

"Riyadh is a big city that spans wide, from south to north, from east to west, while other festivals focus on central areas, but for Riyadh, we needed to make it something home-grown, something that is for the people of Riyadh, by the people of Riyadh."

As part of the festival, public art installations are placed in natural locations, such as Wadi Hanifa, and urban locations, such as the King Abdullah Financial District and the Digital City. It will also feature artwork at heritage locations, such as Al Masmak Fortress.

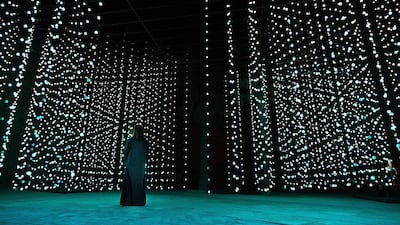

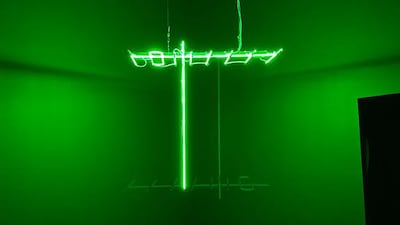

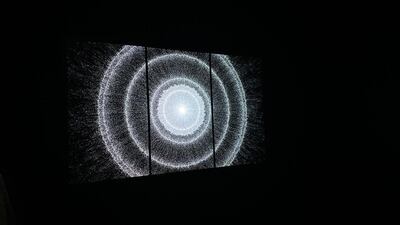

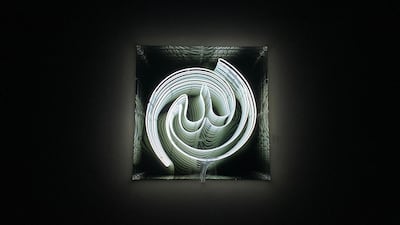

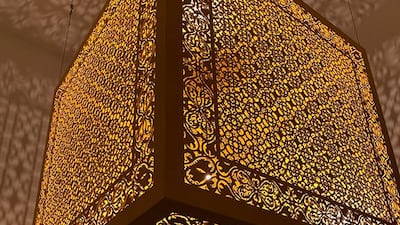

The 30 installations encompass all forms of light art, from sculptures to projections, interactive shows, kinetic and immersive pieces, all of which aim to shed light on Riyadh's diversity and its urban form.

The festival also includes a programme of more than 270 special activities, such as tours, talks, workshops, family activities, film screenings and music, many of which are available online, allowing the festival to be enjoyed by a wider audience outside of Riyadh.

Noor Riyadh's theme for 2021, "Under One Sky", is a unifying one said Hosam Alqurashi, an official at the Royal Commission for Riyadh City, the festival's organising authority.

"In a time where people are going through social distancing, Noor Riyadh comes in as a beacon of hope. Multiple artists coming to one beautiful initiative like this promotes a message to the world that art is a universal language," Alqurashi said.

Beside the citywide installations that will illuminate the capital, the festival features "Light Upon Light: Light Art Since the 1960s", the largest retrospective exhibition of lightworks that features the work of 30 artists.

In this special iteration of "Light Upon Light", Saudi artists' works are featured in each of the four sections of the exhibition.

One of the festival's aims is to discover and nurture local Saudi talents and link them with international ones.

"We are proud to say that 40 per cent of the artists participating in all of Noor Riyadh are Saudi," said Alqurashi.

Producing an international festival of this magnitude during the pandemic was not an easy task, Blanco-Carrasco explained.

"Flying so many tons of cargo around the world and bringing teams to install this from many international locations has been very challenging, but we're all very pleased that we are here today," he said.

To ensure the safety of the festival's visitors, a number of Covid-19 measures are in place, including a mask policy, ticketed activities for capacity management, temperature screening at the entrance to indoor venues and a paperless policy, with a festival app and website.

Noor Riyadh is the first programme of Riyadh Art, a megaproject announced in 2019 to make the city one of the world's artistic capitals.

The project aims to turn Riyadh into a gallery without walls by installing 1,000 art pieces by 2030.

Twelve new projects from Riyadh Art will be announced soon.

Ticket price

Most of the outdoor public exhibitions are non-ticketed and open to all. A small number require prior booking. Special activities, such as workshops, film screenings and talks are ticketed with a nominal charge.

Date

The citywide installations will illuminate Riyadh from Thursday to Saturday, April 3.

The Light Upon Light: Light Art Since the 1960s exhibition will open on Thursday and run until Saturday, June 12, at the King Abdullah Financial District Conference Centre.

Location

Noor Riyadh is a citywide event that can be enjoyed in the following areas: Al Nakheel sports park, Digital City, Diplomatic Quarter General Authority, JAX District, King Abdullah Financial District, King Abdulaziz Historical Centre, Jeddah Tower, King Fahad National Library, Al Masmak Fortress, Riyadh Front, At-Turaif District World Heritage Site, Wadi Hanifah Stone Dam Park and Wadi Namar Park.