UAE's Federal Tax Authority has released an example of a receipt from a business registered for value added tax.

The FTA said that four items on the receipt should be clearly marked:

- Tax receipt displayed

- Tax registration number

- Price that includes VAT

- Amount of VAT added

In a brief statement the FTA called on consumers "to review tax invoices as businesses can’t charge VAT if they were not registered".

VAT in the UAE came into effect on January 1, 2018.

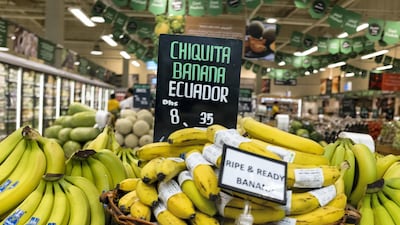

Here's a handy list of items that are being charged and those that are not:

______________

Read more:

VAT: A boon for UAE accounting firms

VAT is a worry for some and not so much for others

Video: VAT in the UAE explained