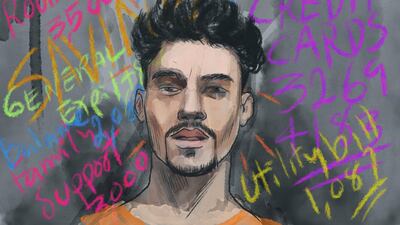

I have personal loan of Dh124,600 as well as about Dh7,450 outstanding on two credit cards (Dh3,269 from the same bank as the loan and Dh4,183 on a card from another bank). I want to find a way to settle my debts before I end up in jail. I built up the debt by taking out a loan for Dh60,000 to help my wife establish her business in our home country of Ethiopia. Then after six months I topped it up with a further Dh50,000 to strengthen the business. Despite all her efforts she was not successful because she was working with an untrustworthy relative. So, I took a final top up of Dh30,000 to close the business and clear her liabilities. However, I also used some of that money for my budget deficiencies here in the UAE and to visit my family for a holiday because I have no savings. I work as a medical microbiologist in a government hospital earning Dh7,725. The money I owe is:

• Bank loan repayment: Dh3,275

• Room rent: Dh3,500 (this is the last installment and I will not renew)

• Utility bill: Dh1,087

• Credit cards: Dh7,452 – my minimum payments total Dh1,087

If you look at my expenditure below, I currently cannot pay off my credit card:

• Bank loan repayment: Dh3,275

• Family: Dh3,000 to support my mother, wife and three daughters as well as my ex-wife and two sons

• General expenses in the UAE: Dh1,450

What can I do to resolve this situation? MA, Ajman

Debt panellist 1: Philip King, the head of retail banking at Abu Dhabi Islamic Bank

I’m glad you have recognised your predicament and are seeking financial advice before it is too late. The short answer to your question is fairly straightforward – you need to find a way to clear your debt, which is certainly doable, in a pragmatic and disciplined manner.

The first step should be to clear the amount outstanding on your cards, as these will be charging the highest rate. At Dh7,450, this is achievable in your case and should be your first goal. Speak to your bank, as they may allow you to convert your remaining card debt into the existing personal finance to create a consolidated single monthly payment. This will simplify your journey out of debt while also lowering repayments currently being eaten up by high rates. At the same time, you should discuss the option of decreasing the monthly payment so that you can agree a sustainable programme of repayments that is achievable. For example, if you could agree a monthly repayment of around Dh3,000, you will eventually pay the entire debt off and be debt free in just over three years.

Over the long-term, and where possible, I’m afraid you must also attempt to lower your monthly expenses. The most obvious option, which you have already referenced in your question, is your monthly rent – moving to lower cost accommodations will give you more flexibility in finance payments while allowing you to support your family. If it is possible to switch to cheaper utility packages, then this should also be a priority. In addition, if you can afford to send less money home, even for a short period, this will also benefit you in the long run. Selling any assets that you don’t need would also help raise money to contribute to rebalancing your financial situation.

So, in summary, approach your bank for a consolidation of the cards into one finance program and ask whether you can lower your monthly repayment commitment. Make adjustments to your current outgoings, such as how much money you are sending home to family or your living expenses, until you are on track with your repayments, and, if possible, sell any superfluous assets to shore up your finances.

_________

Read more:

The Debt Panel: British couple struggling to shift 'niggly' Dh80,000 credit card debt

_________

Debt panellist 2: Ambareen Musa, founder and chief executive of Souqalmal.com

Since you mention that your personal loan and one of the credit cards is from the same bank, how about approaching this bank to consolidate all three of your debts? Even if the bank only agrees to consolidate the two debts on its books, it would leave you with a much more manageable repayment schedule. Debt consolidation would help roll your existing loan and credit card debt into one consolidated loan and lower your monthly repayments. But you should aim to obtain a lower interest rate under this new arrangement.

Now, you also cannot ignore the credit card debt, which doesn't seem huge so far, but can quickly multiply if you're not careful. With average annual credit card interest rates in the UAE close to 40 per cent (known as the Annual Percentage Rate or APR), credit card debt can spiral out of your control. If you're able to secure a debt consolidation for two of your debts, make it your priority to repay and close down the other credit card through your own means.

Your salary of Dh7,725 can only stretch so much. So it would be a good idea to look for some part-time work or freelance opportunities to help you unlock an additional income stream. Here's an idea: since you are a microbiologist, how about looking for a temporary teaching position at a university or school, or even consider a tutoring opportunity. Make sure to first consider the legal aspects of taking on such employment.

In the future, be careful how you use debt. Don't take out a loan unless you have both a Plan A and Plan B to keep up with the repayments.

_________

Read more:

_________

Debt panellist 3: Michael Routledge, the founder of the debt advice site savememoney.ae.

I am unsure why you were offered over Dh124,000 in loans with an income of Dh7,725. The repayments are around 50 per cent of your total salary so with the credit cards, and other commitments on top of that, your financial burden far outweighs your monthly income.

One major issue I see with the information you’ve provided is that even without the debt you can barely afford to support yourself and your family, so you’re really going to have to cut costs as far as your rent/utilities are concerned.

In cases such as this you have two real options:

• Option 1: Visit the download page of our site and use the tools we provide free of charge to show a transparent view of your finances to your lenders. In addition to this I suggest that you contact the Al Etihad Credit Bureau and request your credit report, this will add weight to your request to reschedule your debts with your lenders so hopefully you can reduce your monthly outgoings with both creditors and others.

• Option 2: Contact one of the many debt-rescheduling companies within the UAE and request they take your case on with your creditors. You need to pay for this service, however it may be money well spent in your case if you don’t have the confidence to go with option 1. While Savememoney.ae does not affiliate with any of the UAE’s debt management firms, I have personally spent some time with Gaurav Bhalla, the chief executive of Lotus Loans and Reschedule Services during my time working with the National’s Debt Panel initiative and I know he has had a lot of success helping people with their debt issues in the UAE.

Good luck with your journey to become debt free, and please feel free to contact us should you require any further guidance.

On this panel this week: Philip King, the head of retail banking at Abu Dhabi Islamic Bank; Ambareen Musa, founder and chief executive of Souqalmal.com and Michael Routledge, the founder of the debt advice site savememoney.ae.

The Debt Panel is a weekly online column to help readers tackle their debts more effectively. If you have a question for the panel, write to pf@thenational.ae.