The Central Bank of Egypt raised interest rates in its second meeting of the year, a move that had been widely expected by analysts after annual inflation soared to a new high last month.

The bank’s monetary policy committee increased its overnight deposit rate, overnight lending rate and the rate of the main operation by 200 basis points to 18.25 per cent, 19.25 per cent and 18.75 per cent, respectively.

The discount rate was also raised by 200 bps to 18.75 per cent.

Recent inflation developments necessitated "additional tightening in the monetary stance, not only to contain demand side pressures ... but also to avoid broad and persistent inflationary effects that could emanate from the supply shocks, with the aim of anchoring inflation expectations", the committee said on Thursday.

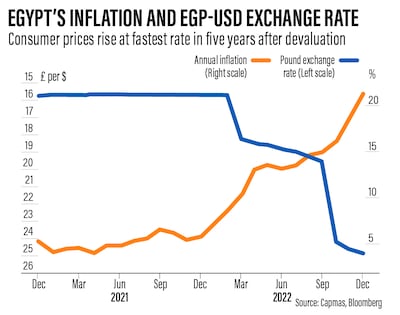

Egypt’s annual inflation rate climbed to 32 per cent last month, up from about 26 per cent in January.

Food prices and core inflation have hit all-time highs, increasing 62 per cent and 40 per cent annually, respectively.

The country’s economic woes have been compounded by Russia’s invasion of Ukraine last February, resulting in supply chain issues, higher import costs and a foreign currency shortage.

After a series of currency devaluations, the Egyptian pound has lost nearly half of its value against the dollar.

The MPC cited supply chain disruption domestically, the depreciation of the Egyptian pound, demand side pressures and high broad money growth outturns as factors that have contributed to inflation.

It also noted that the seasonal impact of Ramadan had affected Umrah trips and food prices.

To cushion the impact of inflation on lower-income households, the government plans to increase spending on food subsidies by 20 per cent and fuel subsidies by 24 per cent in its draft budget, which was approved by the cabinet on Wednesday.

Egypt has also revised downwards its real gross domestic product growth rate target for the 2023-2024 fiscal year that begins on July 1 to 4.1 per cent, from the previously targeted 5.5 per cent in December.

Most analysts expected a rate increase of between 150 and 300 basis points, after the bank held rates steady at its first meeting of the year on February 2.

The central bank raised interest rates by a cumulative 800bps last year, with the last hike of 300bps in December.

There was speculation before the meeting that the bank would devalue the currency for a fourth time.

The greenback is currently trading at 35 to 36 pounds on the parallel market, while 12-month non-deliverable forwards are pointing to 40 pounds. The official rate has held at 30.96 pounds for almost three weeks.

The CBE could be enticed to further weaken the pound due to “challenging FX liquidity dynamics” and the International Monetary Fund’s pending review, Naeem Holding said in a note on Thursday.

The IMF agreed to extend a $3 billion facility to Egypt last year, contingent on the country introducing a flexible foreign exchange policy, carrying out structural reforms and reducing the state’s footprint in the economy.

However, Naeem said the exchange rate could equally be left unchanged for the time being because no fresh funds have been secured from abroad, “usually a prelude to a shift in the exchange rate policy”.

Capital Economics expects that inflation will accelerate in March and April, with the headline rate peaking "at just shy of 40 per cent year-on-year" next month, said James Swanston, emerging markets economist at the research firm.

"After April, the headline inflation rate should slow, but will remain at elevated levels well into 2024 and won't return within the CBE’s target range until the second half of next year," Mr Swanston told The National.

"Until that time, we do not expect interest rate cuts to come on to the agenda."

Amr Elalfy, head of research at Cairo-based Prime Holding, said in a research note on Thursday: “We believe inflation in Egypt is not transitory and will remain higher for longer, at least in 2023."

The investment bank had expected a 200bps rise and sees inflation averaging 31.4 per cent this year, peaking in March at 35.4 per cent for headline and 41.7 per cent for core readings.

“Inflation won’t cool down until next year. It’s mostly imported inflation — because higher prices are due to a large extent to a stronger US dollar — and supply driven,” Mr Elalfy told The National.

At the same time, the effect of the tighter monetary environment is such that it could lead to slower economic growth and lower consumption, he said.

Goldman Sachs and Japanese bank MUFG expect inflation to peak in the third quarter of 2023, north of 35 per cent year on year, barring any further devaluations.

Monetary tightening is necessary due to runaway inflation and the need for the CBE to restore its credibility, “though other reforms are also required to tackle the deep structural challenges facing the economy and attract foreign investment”, Abu Dhabi Commercial Bank economists said in a report this month.

Egypt is “between a rock and a hard place” with large external financing needs weighing on the macroeconomic outlook, Morgan Stanley said in a report released earlier this week, echoing the need to make progress on structural reforms.

Last week, the World Bank approved a new Country Partnership Framework for Egypt that provides the country with $7 billion in funds over the 2023 to 2027 fiscal years.

The agreement aims to boost job creation in the private sector, improve health and education services and strengthen social protection programmes.